Influence of Health Trends

The Stainless Steel cookware Market is significantly influenced by health trends, as consumers become more aware of the materials used in their cookware. Stainless steel is often perceived as a healthier option compared to non-stick alternatives, which may contain harmful chemicals. This perception is driving consumers to opt for stainless steel cookware, as it does not leach chemicals into food during cooking. Market Research Future indicates that the health-conscious segment of the population is expanding, leading to increased sales of stainless steel cookware. As awareness of the potential health risks associated with certain cookware materials grows, the stainless steel cookware market is likely to see sustained demand from consumers prioritizing their health and well-being.

Growing Interest in Culinary Arts

The Stainless Steel Cookware Market benefits from a growing interest in culinary arts and home cooking. As more individuals take up cooking as a hobby or a lifestyle choice, the demand for high-quality cookware has surged. Stainless steel cookware is often favored by both amateur and professional chefs for its excellent heat conductivity and versatility. Recent surveys indicate that a significant percentage of consumers are investing in premium cookware to enhance their cooking experience. This trend is likely to continue, as cooking shows and social media platforms inspire more people to experiment in the kitchen. Consequently, the stainless steel cookware market is poised for growth as it caters to this burgeoning interest in culinary skills.

Rising Demand for Durable Cookware

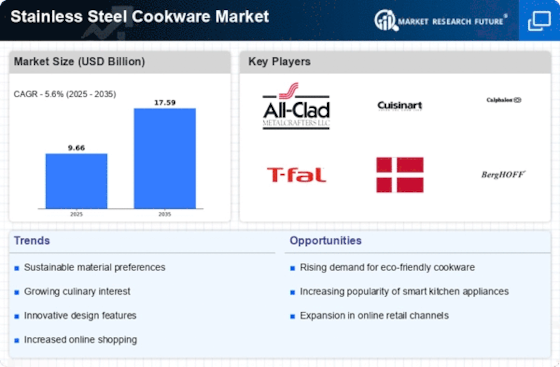

The Stainless Steel Cookware Market experiences a notable increase in demand for durable and long-lasting cookware. Consumers are increasingly seeking products that offer longevity and resistance to wear and tear. Stainless steel, known for its robustness, aligns perfectly with this consumer preference. According to recent data, the market for stainless steel cookware is projected to grow at a compound annual growth rate of approximately 5.5% over the next five years. This growth is driven by the perception that stainless steel cookware is a worthwhile investment, as it does not easily warp or corrode, thus ensuring a longer lifespan compared to alternatives. As consumers become more discerning about their kitchenware, the emphasis on durability is likely to propel the stainless steel cookware market further.

Shift Towards Eco-Friendly Products

The Stainless Steel Cookware Market is witnessing a shift towards eco-friendly products, as consumers become more environmentally conscious. Stainless steel is inherently recyclable, which appeals to a growing demographic that prioritizes sustainability in their purchasing decisions. This trend is reflected in the increasing number of brands that emphasize the eco-friendly attributes of their stainless steel cookware. Market data suggests that the demand for sustainable kitchenware is expected to rise, with a significant portion of consumers willing to pay a premium for products that align with their values. This shift not only enhances brand loyalty but also positions stainless steel cookware as a preferred choice for environmentally aware consumers, thereby driving growth in the market.

Technological Advancements in Cookware

The Stainless Steel Cookware Market is experiencing a wave of technological advancements that enhance product performance and consumer appeal. Innovations such as improved heat distribution, ergonomic designs, and compatibility with various cooking surfaces are becoming increasingly prevalent. These advancements not only improve the cooking experience but also attract a tech-savvy consumer base. Data suggests that cookware featuring advanced technology is gaining traction, with consumers willing to invest in products that offer enhanced functionality. As manufacturers continue to innovate and introduce new features, the stainless steel cookware market is expected to expand, catering to the evolving needs and preferences of modern consumers.