Increased Regulatory Standards

Increased regulatory standards regarding material performance and safety are influencing the duplex stainless-steel-pipe market. Industries such as construction, oil and gas, and chemical processing are subject to stringent regulations that mandate the use of high-quality materials. Duplex stainless steel, with its superior corrosion resistance and mechanical properties, meets these regulatory requirements effectively. As compliance becomes more critical, the demand for duplex stainless-steel pipes is likely to rise. In 2025, it is anticipated that regulatory pressures will contribute to a market growth rate of approximately 5%, as companies prioritize safety and reliability in their operations.

Growing Focus on Energy Efficiency

The duplex stainless-steel-pipe market is influenced by a growing focus on energy efficiency across various industries. Companies are increasingly adopting materials that not only enhance performance but also contribute to sustainability goals. Duplex stainless steel, known for its high strength-to-weight ratio, allows for thinner walls and lighter structures, which can lead to reduced energy consumption during transportation and installation. In 2025, energy-efficient solutions are expected to represent a significant portion of the market, as industries strive to meet regulatory standards and consumer expectations. This trend indicates a promising outlook for the duplex stainless-steel-pipe market as it aligns with broader energy efficiency initiatives.

Rising Demand in Oil and Gas Sector

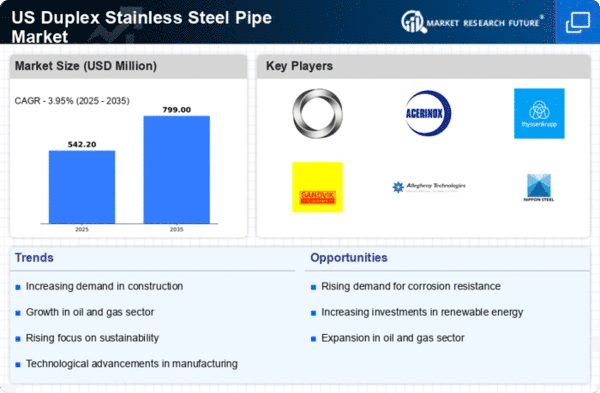

The duplex stainless-steel-pipe market experiences a notable surge in demand driven by the oil and gas sector. This industry relies heavily on materials that can withstand high pressures and corrosive environments, making duplex stainless steel an ideal choice. In 2025, the oil and gas sector is projected to account for approximately 30% of the total market share. The increasing exploration and production activities, particularly in shale gas and offshore drilling, further bolster the need for durable piping solutions. As companies seek to enhance operational efficiency and reduce maintenance costs, the duplex stainless-steel-pipe market is likely to benefit significantly from this trend.

Infrastructure Development Initiatives

Infrastructure development initiatives in the United States are poised to drive growth in the duplex stainless-steel-pipe market. With the government focusing on modernizing aging infrastructure, there is a heightened demand for robust materials that can endure harsh conditions. The anticipated investment of $1 trillion in infrastructure projects over the next decade is expected to create substantial opportunities for the duplex stainless-steel-pipe market. These pipes are favored for their strength and resistance to corrosion, making them suitable for various applications, including water supply and wastewater management. As infrastructure projects gain momentum, the market is likely to see a corresponding increase in demand.

Technological Innovations in Manufacturing

Technological innovations in manufacturing processes are reshaping the duplex stainless-steel-pipe market. Advanced techniques such as additive manufacturing and precision casting are enhancing the production efficiency and quality of duplex stainless steel pipes. These innovations allow for the creation of complex geometries and customized solutions that meet specific industry requirements. As manufacturers adopt these technologies, the market is likely to witness a reduction in production costs and lead times, making duplex stainless steel pipes more accessible to a wider range of applications. This shift towards advanced manufacturing is expected to drive growth in the duplex stainless-steel-pipe market.