By Region, the Stainless-Steel IBC’s market is segmented into North America, South America, Europe, Asia Pacific, and Middle East and Africa. North America accounted for the largest market share of 35% in 2022 with a market value of USD 991.59 million; it is expected to register a CAGR of 4.34% during the forecast period. The Stainless-Steel IBC adhering to United Nation, or the U.S. Department of Transportation certification are anticipated to mitigate the risk associated with transportation of liquid products. This resulted in exponential sales of Stainless-Steel IBC in the voluminous industries.

The U.S. is expected to remain at the leading position in the global Stainless Steel IBC market during the assessment period. As per the U.S. Department of Energy office of Energy Efficiency & Renewable Energy, the U.S. is the top producer of chemicals in the world and accounting for 1/5th share of world's chemical production. Also, as per the report published by BASF, the chemical production in the U.S. is expected to increase by year over year growth of 4.5% in 2021-2022. Strong demand for the chemicals from automotive, energy sector and consumer goods industries will boost the market.

The pharmaceutical industry is also a significant contributor to the growth of the North American stainless steel IBCs market, as these containers are used to store and transport sensitive drugs and vaccines. In terms of region, the United States is expected to be the largest market for stainless steel IBCs in North America, due to the presence of many chemical, food & beverage, and pharmaceutical companies.

The European stainless steel IBCs market is also expected to grow in the coming years, driven by increasing demand from various industries such as chemical, food & beverage, and pharmaceuticals. Stainless steel IBCs are preferred over other materials due to their durability, corrosion resistance, and ability to withstand extreme temperatures. The chemical industry is a major user of stainless-steel IBCs in Europe, as they are used to transport and store a wide range of chemicals and hazardous materials.

The food & beverage industry also heavily relies on stainless steel IBCs for the storage and transportation of food products, as they meet the EU regulations for food contact. In terms of region, Western Europe is expected to be the largest market for stainless steel IBCs in Europe, due to the presence of many chemical, food & beverage, and pharmaceutical companies in countries like Germany, France, and the United Kingdom. Overall, stainless steel IBCs are a popular choice in Europe due to their many benefits, and the market is expected to continue growing in the coming years.

Asia-Pacific is expected to register the highest growth rate among the other regions during the forecasted period. China is dominating the Asia-Pacific market due to rising population, which drives up demand for metal IBC due to inherent development in healthcare and pharmaceutical industry. East Asian countries continue to offer significant opportunities for steel drums & IBC manufacturers. The demand for Stainless Steel IBCs Market in China, South Korea, and other East Asian countries is majorly driven by increased spending on trade activities and the growing demand for chemical packaging.

The growing investments in increasing production facilities is likely to create significant growth opportunities for market players over the course of the forecast period. In addition to East Asia, South Asia is likely to remain a lucrative region for the Stainless-Steel IBCs market on account of the expansion of end-use industries which are likely to push the demand during the assessment period.

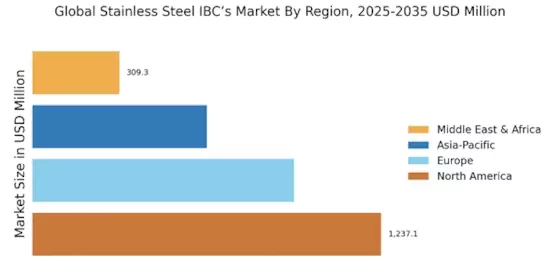

Figure4: Global Stainless Steel IBC’s Market Size By Region 2022 & 2032 (USD Million)

The stainless-steel IBCs market in South America is growing rapidly due to increasing demand from food and beverage, pharmaceutical, and other industrial sectors. The demand for IBCs is expected to grow further in the coming years due to the rise in production and consumption of various food and beverage products, pharmaceuticals, and chemicals in the region. The region has many international manufacturing and distribution hubs, which has resulted in an increase in the demand for these containers. The major countries in South America that have increased their demand for stainless steel IBCs are Brazil, Colombia, Peru, Chile, and Argentina.

In Brazil, the demand is driven by the increasing production of food and beverage products, pharmaceuticals, and chemicals. Colombia is also a major contributor to the growth of the market due to its large pharmaceutical industry. The demand for stainless steel IBCs in Peru and Chile is increasing due to their rising food and beverage production. The demand in Argentina is also growing due to the increasing demand for various industrial products.

The chemical industry is a major user of stainless-steel IBCs in Brazil and Argentina, as they are used to transport and store a wide range of chemicals and hazardous materials. The food & beverage industry also heavily relies on stainless steel IBCs for the storage and transportation of food products, as they meet the regulations for food contact.

Growing industrialization and urbanization, especially in the emerging countries of the region, have spurred the demand for a variety of commodities, including chemicals, thus driving the demand for stainless steel IBCs. In terms of region, the Gulf Cooperation Council (GCC) countries are expected to be the largest market for stainless steel IBCs in the MEA region, due to the presence of many chemical, food & beverage, and pharmaceutical companies.

Countries like Saudi Arabia, UAE, and Qatar are expected to be the largest market for stainless steel IBCs in the Middle East, due to the presence of many oil and gas, chemical and food & beverage companies. The oil and gas industry are a major user of stainless-steel IBCs in the Middle East, as they are used to transport and store a wide range of chemicals and hazardous materials used in the oil and gas production processes.

The market for stainless steel IBCs in Africa is still relatively small compared to other regions, due to the lack of industrialization and economic development in some parts of the continent. Additionally, the high cost of stainless-steel IBCs may also be a barrier for some companies in Africa.