Rising Demand in Electronics

The Global Specialty Glass Market Industry experiences a surge in demand driven by the electronics sector. Specialty glass is integral in the production of displays, sensors, and optical components, which are essential for smartphones, tablets, and other electronic devices. As the global electronics market continues to expand, projected to reach 9.06 USD Billion in 2024, the need for high-performance specialty glass is likely to increase. This trend is further supported by advancements in technology, which necessitate the use of specialized materials that offer superior durability and functionality. Consequently, the growth of the electronics industry significantly influences the trajectory of the Global Specialty Glass Market Industry.

Healthcare Sector Innovations

The Global Specialty Glass Market Industry is also influenced by innovations within the healthcare sector. Specialty glass is utilized in various medical devices, laboratory equipment, and pharmaceutical packaging, which are essential for ensuring safety and efficacy in healthcare applications. As the healthcare industry continues to evolve, driven by technological advancements and an increasing focus on patient care, the demand for specialty glass products is expected to rise. This trend is indicative of a broader movement towards high-quality materials that meet stringent regulatory standards, further propelling the growth of the Global Specialty Glass Market Industry.

Emerging Markets and Urbanization

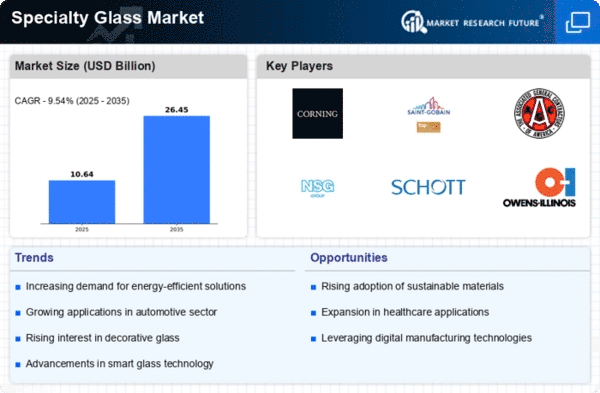

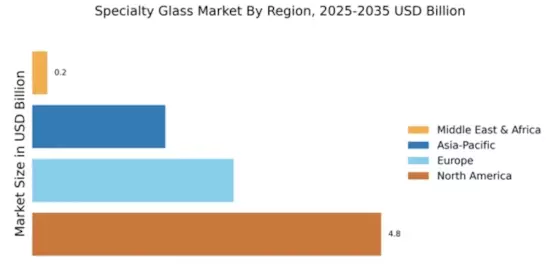

The Global Specialty Glass Market Industry is experiencing growth fueled by urbanization and the expansion of emerging markets. As urban populations increase, there is a heightened demand for construction materials, including specialty glass for buildings and infrastructure. This trend is particularly evident in developing regions where rapid urbanization is occurring. The market is projected to reach 15.5 USD Billion by 2035, highlighting the potential for growth in these areas. The increasing focus on modern architecture and sustainable building practices further enhances the demand for specialty glass, positioning the Global Specialty Glass Market Industry for continued expansion.

Advancements in Automotive Technology

The Global Specialty Glass Market Industry is poised for growth due to advancements in automotive technology. Specialty glass is increasingly used in vehicle manufacturing, particularly in windshields, windows, and displays. The automotive sector is undergoing a transformation with the rise of electric and autonomous vehicles, which often require specialized glass solutions for enhanced safety and performance. As the automotive industry evolves, the demand for innovative glass products is likely to increase, contributing to the market's expansion. With the automotive sector's projected growth, the Global Specialty Glass Market Industry stands to benefit significantly from these technological advancements.

Growth in Renewable Energy Applications

The Global Specialty Glass Market Industry is significantly impacted by the increasing adoption of renewable energy technologies. Specialty glass is utilized in solar panels and energy-efficient windows, contributing to the overall efficiency and performance of these systems. As governments worldwide implement policies to promote sustainable energy solutions, the demand for specialty glass in renewable applications is expected to rise. The market is projected to grow at a CAGR of 5.0% from 2025 to 2035, reflecting the growing emphasis on sustainability. This shift towards renewable energy not only enhances the market potential for specialty glass but also aligns with global efforts to reduce carbon emissions.