Market Trends

Key Emerging Trends in the Specialty Glass Market

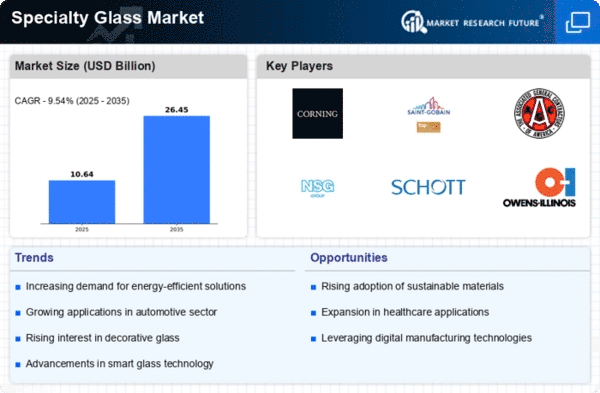

The specialty glass market is witnessing significant trends that are reshaping its dynamics and expanding its applications across various industries. Specialty glass, known for its unique properties such as high chemical resistance, thermal stability, and optical clarity, is gaining traction in sectors like electronics, healthcare, and construction. One notable trend is the increasing demand for specialty glass in the electronics industry. As electronic devices become more sophisticated and compact, the need for high-performance glass with exceptional properties, such as scratch resistance and durability, is on the rise. Specialty glass finds applications in the manufacturing of display screens, touch panels, and optical components, contributing to the growth of the electronics sector.

Moreover, the market is experiencing a surge in demand from the healthcare industry, particularly in the manufacturing of medical devices and laboratory equipment. Specialty glass is preferred for its biocompatibility, inertness, and ability to withstand harsh chemical environments. It is used in the production of medical implants, diagnostic instruments, and pharmaceutical packaging. The increasing focus on healthcare infrastructure and advancements in medical technology are driving the demand for specialty glass in this sector.

Additionally, there is a growing emphasis on sustainable and energy-efficient solutions, influencing the use of specialty glass in the construction industry. Specialty glass products, such as energy-efficient windows, smart glass, and architectural glass with enhanced thermal insulation, are gaining popularity. These solutions contribute to energy conservation by improving the building's insulation and allowing for better natural light utilization, thereby reducing the need for artificial lighting and heating. As sustainability becomes a key consideration in construction projects, the adoption of specialty glass is expected to increase.

The market is also witnessing innovations in glass technology, leading to the development of new and advanced specialty glass products. Nanotechnology and thin-film coatings are being utilized to enhance the performance of specialty glass, making it more resistant to fingerprints, scratches, and environmental factors. Anti-reflective coatings and self-cleaning properties are becoming common features in specialty glass products, catering to consumer preferences for low-maintenance and high-durability materials.

Furthermore, the automotive industry is a significant consumer of specialty glass, particularly in the manufacturing of advanced automotive glazing. Specialty glass is used for windshields, windows, and sunroofs, providing features such as UV protection, noise reduction, and enhanced safety. The trend towards electric and autonomous vehicles is further driving the demand for lightweight and high-performance materials, positioning specialty glass as a crucial component in the automotive sector's evolution.

Despite these positive trends, challenges exist within the specialty glass market. Fluctuations in raw material prices, such as those of silica and other components used in glass production, can impact manufacturing costs for glass producers. Additionally, the COVID-19 pandemic has disrupted supply chains and affected the manufacturing and demand for specialty glass in various industries.

Leave a Comment