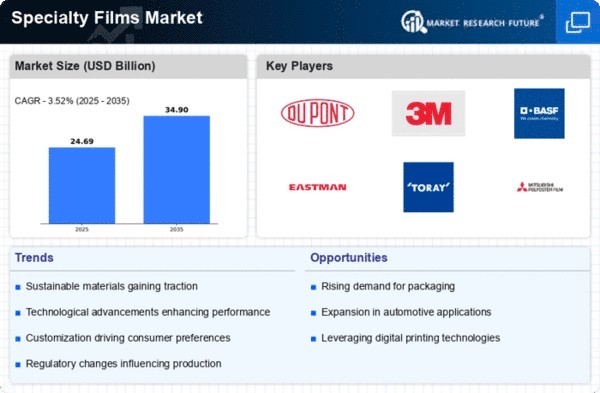

Market Growth Projections

The Global Specialty Films Market Industry is projected to experience steady growth, with a market value expected to reach 34.9 USD Billion by 2035. This growth trajectory is underpinned by a compound annual growth rate (CAGR) of 3.52% from 2025 to 2035. The increasing adoption of specialty films across various sectors, including packaging, automotive, and healthcare, contributes to this positive outlook. As industries continue to innovate and seek advanced materials, the specialty films market is likely to expand, driven by technological advancements and evolving consumer preferences. This growth potential suggests a dynamic future for the specialty films industry, characterized by ongoing developments and opportunities.

Expanding Applications in Healthcare

The Global Specialty Films Market Industry is witnessing an expansion in applications within the healthcare sector, driven by the increasing demand for medical packaging and devices. Specialty films are utilized in various healthcare applications, including sterile packaging for medical devices, drug delivery systems, and wound care products. The need for high-performance films that offer barrier protection, moisture resistance, and sterilization compatibility is paramount in this sector. As the healthcare industry continues to innovate and expand, the demand for specialty films is expected to grow, reflecting the critical role these materials play in ensuring product safety and efficacy. This trend highlights the versatility and importance of specialty films in meeting healthcare needs.

Growing Demand for Flexible Packaging

The Global Specialty Films Market Industry experiences a notable surge in demand for flexible packaging solutions. This trend is largely driven by the increasing consumer preference for lightweight and convenient packaging options. Flexible films are not only cost-effective but also provide enhanced barrier properties, which are essential for preserving product freshness. As of 2024, the market is valued at approximately 23.9 USD Billion, indicating a robust growth trajectory. The shift towards sustainable packaging materials further propels this demand, as manufacturers seek to reduce their environmental footprint while meeting consumer expectations. This evolving landscape suggests a promising future for flexible packaging within the specialty films sector.

Increased Focus on Sustainable Solutions

Sustainability emerges as a crucial driver within the Global Specialty Films Market Industry, as consumers and businesses alike prioritize eco-friendly materials. The shift towards biodegradable and recyclable films reflects a broader commitment to reducing plastic waste and environmental impact. Manufacturers are responding by developing specialty films that meet stringent sustainability standards while maintaining performance characteristics. This trend is particularly evident in the packaging sector, where brands are increasingly adopting sustainable films to appeal to environmentally conscious consumers. The growing regulatory pressure to minimize plastic usage further accelerates this transition, suggesting that sustainability will remain a key focus area for the specialty films market in the coming years.

Rising Applications in the Automotive Sector

The automotive sector emerges as a significant driver for the Global Specialty Films Market Industry, as manufacturers increasingly utilize specialty films for various applications. These films are employed in interior and exterior components, providing aesthetic appeal and functional benefits such as UV protection and thermal insulation. The growing emphasis on lightweight materials in automotive design aligns with the properties of specialty films, which contribute to improved fuel efficiency and reduced emissions. As the automotive industry continues to evolve, the demand for specialty films is expected to rise, further bolstering the market's growth trajectory. This trend underscores the importance of specialty films in enhancing vehicle performance and sustainability.

Technological Advancements in Film Production

Technological innovations play a pivotal role in shaping the Global Specialty Films Market Industry. Advances in polymer science and film extrusion techniques have led to the development of high-performance films that cater to diverse applications, including automotive, electronics, and food packaging. These innovations enhance the mechanical properties and thermal stability of specialty films, making them more appealing to manufacturers. Furthermore, the integration of smart technologies, such as sensors and RFID tags, into films is gaining traction, potentially revolutionizing product tracking and inventory management. As the industry embraces these advancements, it is likely to witness sustained growth, with projections indicating a market value of 34.9 USD Billion by 2035.