Rising Healthcare Expenditure

The increase in healthcare expenditure in Spain is a significant driver for the radiology information-system market. As the government allocates more funds to healthcare, there is a corresponding rise in investments in advanced medical technologies, including radiology information systems. Recent reports indicate that healthcare spending in Spain is projected to grow by approximately 5% annually, reflecting a commitment to improving healthcare infrastructure. This trend suggests that healthcare facilities are more likely to invest in modern radiology information systems to enhance operational efficiency and patient care. Consequently, the market is poised for growth as providers seek to leverage these systems to meet the evolving demands of the healthcare landscape.

Increased Focus on Patient-Centric Care

The shift towards patient-centric care in Spain is driving changes in the radiology information-system market. Healthcare providers are increasingly prioritizing patient engagement and satisfaction, which necessitates the implementation of systems that enhance communication and accessibility. Radiology information systems that offer patient portals, appointment scheduling, and easy access to imaging results are becoming essential. This focus on patient-centric solutions is likely to contribute to market growth, as facilities strive to improve the overall patient experience. Furthermore, studies indicate that patient satisfaction scores are closely linked to the efficiency of information systems, suggesting that investments in these technologies could yield significant returns in terms of patient loyalty and trust.

Growing Demand for Telemedicine Services

The rising demand for telemedicine services in Spain is significantly impacting the radiology information-system market. As healthcare providers increasingly adopt remote consultation and diagnostic services, the need for robust radiology information systems becomes paramount. These systems facilitate the efficient sharing of imaging data and reports between radiologists and referring physicians, thereby enhancing patient care. According to recent data, the telemedicine market in Spain is anticipated to reach €1 billion by 2026, indicating a substantial growth trajectory. This trend suggests that radiology information systems must evolve to support telehealth initiatives, ensuring seamless integration and communication across various platforms.

Regulatory Changes Promoting Digital Health

Recent regulatory changes in Spain are fostering a more favorable environment for the radiology information-system market. The government is actively promoting digital health initiatives, which include the adoption of electronic health records and interoperable systems. These regulations are designed to enhance data sharing and improve healthcare delivery across the country. As a result, radiology information systems that comply with these regulations are likely to see increased adoption among healthcare providers. The market is expected to benefit from these regulatory frameworks, which aim to streamline processes and improve the quality of care. This regulatory support may also encourage investment in innovative technologies that align with national health objectives.

Technological Advancements in Imaging Techniques

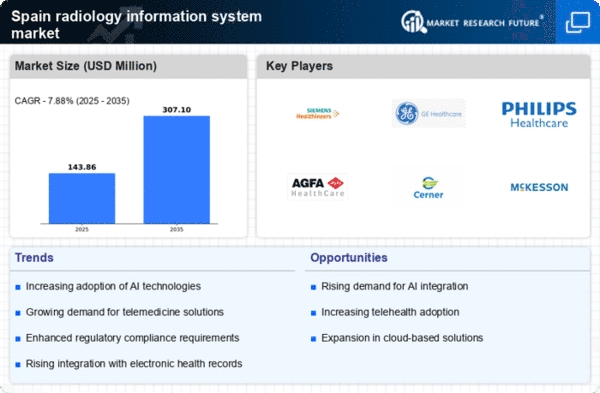

The radiology information-system market in Spain is experiencing a notable transformation due to rapid technological advancements in imaging techniques. Innovations such as 3D imaging, digital radiography, and advanced MRI technologies are enhancing diagnostic accuracy and efficiency. These advancements are likely to drive the adoption of sophisticated radiology information systems, as healthcare providers seek to integrate these technologies into their workflows. The market is projected to grow at a CAGR of approximately 8% over the next five years, reflecting the increasing demand for high-quality imaging solutions. Furthermore, the integration of these advanced imaging techniques into radiology information systems is expected to improve patient outcomes and streamline operations within healthcare facilities.