Rising Healthcare Expenditure

The radiology information system market is benefiting from the rising healthcare expenditure in the UK. Increased funding for healthcare services is enabling hospitals and clinics to invest in advanced radiology information systems that enhance operational efficiency and patient care. According to recent data, the UK healthcare budget is expected to grow by approximately 5% annually, providing a conducive environment for the adoption of innovative technologies. This financial support allows healthcare providers to upgrade their systems, integrate new functionalities, and improve overall service delivery. As a result, the radiology information-system market is likely to expand, driven by the need for modern solutions that align with the evolving demands of the healthcare landscape.

Increased Focus on Patient Safety

Patient safety is a paramount concern within the healthcare sector, and this focus is increasingly impacting the radiology information-system market. In the UK, healthcare providers are prioritizing systems that enhance patient safety through features such as error reduction, improved data accuracy, and streamlined workflows. The implementation of advanced radiology information systems can significantly mitigate risks associated with misdiagnosis and treatment delays. As hospitals and clinics invest in technologies that promote patient safety, the radiology information-system market is likely to witness growth. This trend reflects a broader commitment to quality care and patient-centered practices, which are essential for maintaining high standards in healthcare.

Regulatory Compliance and Standards

Regulatory compliance plays a pivotal role in shaping the radiology information-system market. In the UK, stringent regulations regarding data protection, patient privacy, and healthcare standards necessitate that radiology information systems adhere to specific guidelines. The General Data Protection Regulation (GDPR) and the Health and Social Care Act impose rigorous requirements on data handling and patient consent. As healthcare providers strive to meet these regulations, the demand for compliant radiology information systems is expected to rise. This compliance not only ensures legal adherence but also enhances patient trust and safety. Consequently, the radiology information-system market is likely to see increased investment in systems that prioritize regulatory compliance, thereby fostering a more secure healthcare environment.

Technological Advancements in Imaging

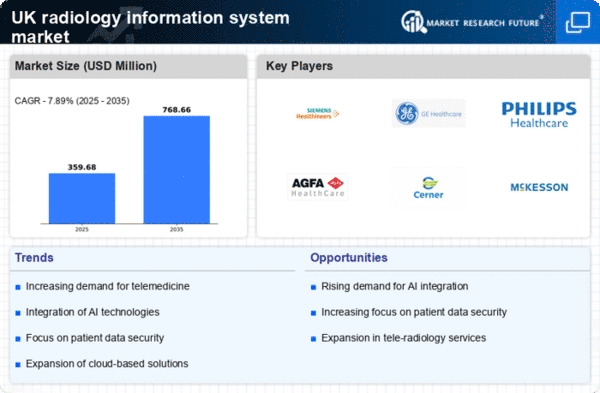

The radiology information system market is experiencing a surge in technological advancements, particularly in imaging modalities. Innovations such as 3D imaging, digital radiography, and advanced MRI techniques are enhancing diagnostic accuracy and efficiency. The integration of these technologies into radiology information systems is crucial for improving workflow and patient outcomes. In the UK, the market for advanced imaging technologies is projected to grow at a CAGR of approximately 8% over the next five years. This growth is driven by the increasing demand for precise diagnostics and the need for systems that can handle complex imaging data. As hospitals and clinics adopt these advanced systems, the radiology information-system market is likely to expand significantly, reflecting the importance of cutting-edge technology in modern healthcare.

Growing Demand for Telemedicine Solutions

The rise of telemedicine is significantly influencing the radiology information-system market. As healthcare providers in the UK increasingly adopt telehealth solutions, the need for robust radiology information systems that support remote diagnostics and consultations is becoming apparent. This shift is driven by the desire to improve access to care, particularly in rural areas where specialist services may be limited. The market for telemedicine in the UK is projected to reach £2 billion by 2026, indicating a substantial opportunity for radiology information systems that can integrate seamlessly with telehealth platforms. By facilitating remote access to imaging data and enabling real-time consultations, these systems are poised to play a critical role in the evolving landscape of healthcare delivery.