Aging Population

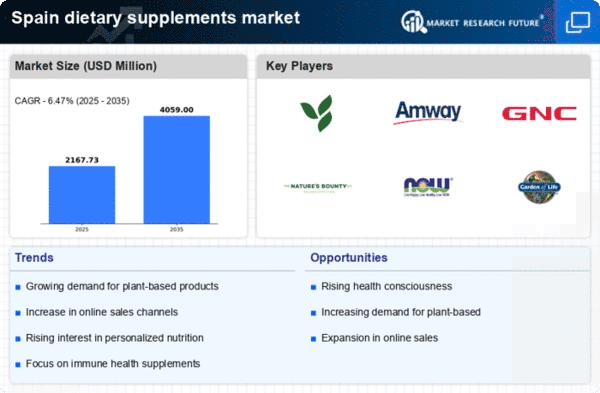

Spain's demographic landscape is characterized by an aging population, which significantly impacts the dietary supplements market. As the proportion of elderly individuals increases, there is a corresponding rise in demand for supplements that address age-related health issues. Products targeting joint health, cognitive function, and cardiovascular support are particularly sought after. The market is expected to grow at a CAGR of around 6% over the next five years, driven by this demographic shift. Older consumers are increasingly turning to dietary supplements to enhance their quality of life and manage chronic conditions. This trend presents a substantial opportunity for manufacturers to develop targeted products that cater to the specific needs of this demographic, thereby driving growth in the dietary supplements market.

E-commerce Growth

The dietary supplements market in Spain is witnessing a transformation due to the rapid growth of e-commerce. Online retail platforms are becoming increasingly popular among consumers seeking convenience and a wider selection of products. In 2025, it is estimated that online sales will account for over 30% of total dietary supplement sales in Spain. This shift towards digital shopping is driven by the ease of access to product information, customer reviews, and competitive pricing. E-commerce allows consumers to compare products and make informed decisions, which is particularly important in the dietary supplements market where quality and efficacy are paramount. As more consumers embrace online shopping, companies are likely to invest in their digital presence, further propelling the growth of the dietary supplements market.

Increasing Health Awareness

The dietary supplements market in Spain is experiencing a notable surge due to the increasing health awareness among consumers. As individuals become more conscious of their dietary choices, there is a growing inclination towards supplements that promote overall well-being. This trend is reflected in the rising sales figures, with the market projected to reach approximately €1.5 billion by 2026. Consumers are actively seeking products that support their health goals, such as vitamins, minerals, and herbal supplements. This heightened awareness is not only driven by personal health concerns but also by a broader societal shift towards preventive healthcare. Consequently, the dietary supplements market is likely to benefit from this trend as more individuals prioritize their health and wellness, leading to sustained growth in the industry.

Regulatory Support and Innovation

The dietary supplements market in Spain is bolstered by regulatory support and ongoing innovation within the industry. The Spanish Agency for Food Safety and Nutrition (AESAN) plays a crucial role in ensuring product safety and efficacy, which fosters consumer trust. This regulatory framework encourages companies to invest in research and development, leading to the introduction of innovative products that meet evolving consumer demands. The market is witnessing a rise in functional supplements that offer specific health benefits, such as probiotics for gut health and omega-3 fatty acids for heart health. As innovation continues to drive product differentiation, the dietary supplements market is expected to thrive, attracting both new entrants and established players.

Rising Interest in Fitness and Wellness

The dietary supplements market in Spain is significantly influenced by the rising interest in fitness and wellness among the population. As more individuals engage in physical activities and prioritize their health, there is an increasing demand for supplements that support athletic performance and recovery. The market for sports nutrition products, including protein powders and energy boosters, is expanding rapidly, with a projected growth rate of 8% annually. This trend is particularly prominent among younger demographics who are more inclined to incorporate supplements into their fitness regimens. The dietary supplements market is likely to benefit from this growing fitness culture, as consumers seek products that enhance their performance and overall health.