Growing Threat Landscape

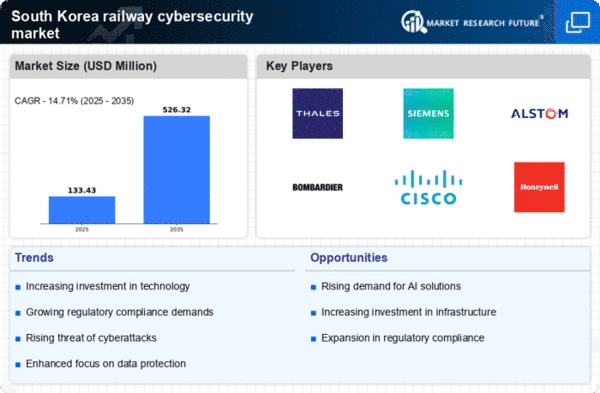

The railway cybersecurity market in South Korea is experiencing heightened demand due to an increasingly complex threat landscape. Cyberattacks targeting critical infrastructure have surged, with reports indicating a rise in incidents by over 30% in recent years. This alarming trend compels railway operators to invest in advanced cybersecurity measures to protect their systems from potential breaches. The need for robust security protocols is underscored by the reliance on digital technologies in railway operations, which, while enhancing efficiency, also introduces vulnerabilities. As a result, stakeholders are prioritizing cybersecurity investments, leading to a projected market growth rate of approximately 15% annually. This growing threat landscape necessitates a proactive approach to cybersecurity, making it a pivotal driver in the railway cybersecurity market.

Increased Public Awareness

Increased public awareness regarding cybersecurity threats is influencing the railway cybersecurity market in South Korea. As incidents of cyberattacks gain media attention, public concern about the safety and security of railway systems has intensified. This heightened awareness prompts railway operators to prioritize cybersecurity measures to maintain public trust and confidence. Surveys indicate that over 70% of passengers express concerns about the potential for cyber threats affecting their travel experience. Consequently, railway companies are investing in advanced cybersecurity solutions to address these concerns and ensure the safety of their operations. This growing public awareness is likely to drive demand for cybersecurity services and products, positioning it as a key driver in the railway cybersecurity market.

Technological Advancements

Technological advancements play a crucial role in shaping the railway cybersecurity market in South Korea. The integration of Internet of Things (IoT) devices and artificial intelligence (AI) in railway systems enhances operational efficiency but also increases exposure to cyber threats. As these technologies evolve, the demand for sophisticated cybersecurity solutions rises correspondingly. The market is projected to reach a valuation of $1 billion by 2027, driven by the need for innovative security measures that can adapt to emerging threats. Furthermore, advancements in encryption and threat detection technologies are enabling railway operators to safeguard sensitive data and maintain system integrity. Consequently, the continuous evolution of technology serves as a significant catalyst for growth in the railway cybersecurity market.

Regulatory Compliance Requirements

Regulatory compliance requirements are becoming increasingly stringent in South Korea, significantly impacting the railway cybersecurity market. The government has implemented various regulations aimed at enhancing the security of critical infrastructure, including railways. Compliance with these regulations is not merely a legal obligation but also a strategic necessity for railway operators. Failure to adhere to these standards can result in substantial fines and reputational damage. As a result, railway companies are compelled to invest in comprehensive cybersecurity frameworks to ensure compliance. This trend is expected to drive market growth, with estimates suggesting an increase in compliance-related expenditures by approximately 20% over the next few years. Thus, regulatory compliance emerges as a vital driver in the railway cybersecurity market.

Investment in Cybersecurity Training

Investment in cybersecurity training is emerging as a critical driver in the railway cybersecurity market in South Korea. As the complexity of cyber threats increases, the need for a skilled workforce capable of addressing these challenges becomes paramount. Railway operators are recognizing that technology alone cannot mitigate risks; human factors play a crucial role in cybersecurity. Consequently, organizations are allocating resources towards training programs aimed at enhancing the cybersecurity skills of their employees. This investment is expected to yield significant returns, as a well-trained workforce can effectively identify and respond to potential threats. The emphasis on training is projected to contribute to a market growth rate of around 12% annually, underscoring its importance in the railway cybersecurity market.