Rising Cyber Threats

The railway cybersecurity market in Japan is experiencing heightened demand. This is due to the increasing frequency and sophistication of cyber threats. Recent reports indicate that cyberattacks targeting critical infrastructure, including rail systems, have surged by over 30% in the past year. This alarming trend compels railway operators to invest in advanced cybersecurity measures to protect sensitive data and ensure operational continuity. The potential financial losses from successful attacks can reach millions of dollars. This makes robust cybersecurity solutions essential. As a result, stakeholders in the railway sector are prioritizing investments in cybersecurity technologies, thereby driving growth in the railway cybersecurity market.

Government Initiatives

The Japanese government is actively promoting initiatives aimed at enhancing cybersecurity across various sectors, including railways. Recent policy frameworks emphasize the importance of securing critical infrastructure against cyber threats. The government has allocated substantial funding, estimated at ¥10 billion, to support the development and implementation of cybersecurity measures in the railway sector. This financial backing encourages railway operators to adopt comprehensive cybersecurity strategies, thereby fostering growth in the railway cybersecurity market. As regulatory compliance becomes increasingly stringent, the alignment of government initiatives with industry needs is likely to bolster the market further.

Increased Public Awareness

Public awareness regarding cybersecurity risks is on the rise in Japan, influencing the railway cybersecurity market. As incidents of cyberattacks gain media attention, passengers and stakeholders demand higher security standards from railway operators. This shift in public perception compels companies to prioritize cybersecurity investments, ensuring the protection of passenger data and operational integrity. Surveys indicate that over 70% of the public considers cybersecurity a critical factor in their travel decisions. Consequently, railway operators are likely to enhance their cybersecurity measures, contributing to the overall growth of the railway cybersecurity market.

Technological Advancements

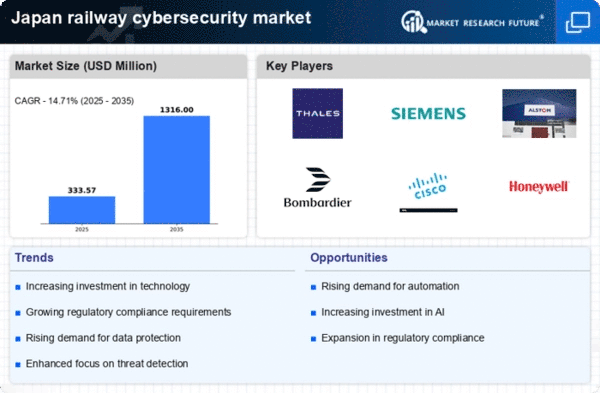

Innovations in technology are significantly influencing the railway cybersecurity market in Japan. The integration of artificial intelligence (AI) and machine learning (ML) into cybersecurity frameworks enhances threat detection and response capabilities. These technologies can analyze vast amounts of data in real-time, identifying anomalies that may indicate a cyber threat. Furthermore, the adoption of Internet of Things (IoT) devices in railway systems increases the attack surface, necessitating advanced cybersecurity solutions. The market is projected to grow at a CAGR of approximately 15% over the next five years, driven by these technological advancements that improve the resilience of railway systems against cyber threats.

International Collaboration

International collaboration in cybersecurity is becoming increasingly relevant for Japan's railway cybersecurity market. Partnerships with foreign governments and organizations facilitate the sharing of best practices and threat intelligence, enhancing the overall security posture of railway systems. Joint exercises and training programs help improve the preparedness of railway operators against potential cyber threats. As Japan seeks to align its cybersecurity strategies with international standards, the railway cybersecurity market is expected to benefit from these collaborative efforts. This trend may lead to the adoption of more sophisticated cybersecurity solutions, further driving market growth.