Growing Threat Landscape

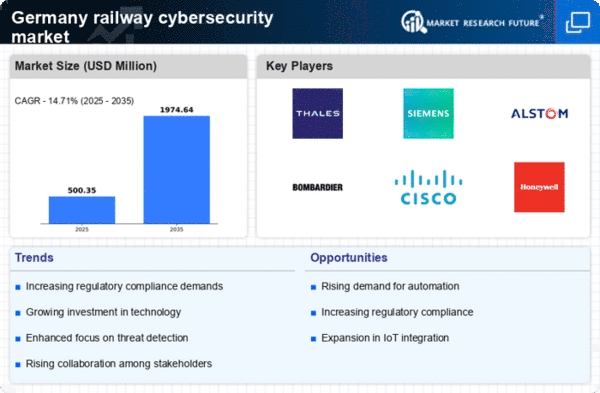

The railway cybersecurity market in Germany is experiencing heightened demand. This is due to an increasingly complex threat landscape. Cyberattacks targeting critical infrastructure have surged, with reports indicating a rise in incidents by over 30% in recent years. This alarming trend compels railway operators to invest in advanced cybersecurity measures to safeguard their systems. The integration of IoT devices and digital technologies in railway operations amplifies vulnerabilities. This makes robust cybersecurity solutions essential. As the reliance on technology grows, the railway cybersecurity market is likely to expand significantly, with projections suggesting a compound annual growth rate (CAGR) of around 12% through 2027. This growth reflects the urgent need for comprehensive security frameworks to protect against evolving cyber threats.

Technological Advancements

Technological advancements play a pivotal role in shaping the railway cybersecurity market in Germany. The adoption of artificial intelligence (AI) and machine learning (ML) technologies is transforming how railway operators detect and respond to cyber threats. These innovations enable real-time monitoring and predictive analytics, enhancing the overall security posture of railway systems. Furthermore, the integration of blockchain technology is emerging as a potential solution for securing data transactions within the railway ecosystem. As these technologies evolve, they are likely to drive the demand for advanced cybersecurity solutions, with market analysts estimating a growth rate of approximately 15% in the next five years. The railway cybersecurity market is thus positioned to benefit from these technological advancements, ensuring safer and more resilient operations.

Government Initiatives and Funding

In Germany, government initiatives aimed at enhancing cybersecurity in critical sectors are driving growth in the railway cybersecurity market. The federal government has allocated substantial funding to bolster cybersecurity infrastructure, with investments exceeding €100 million in recent years. These initiatives focus on developing advanced security protocols and fostering collaboration between public and private entities. The establishment of cybersecurity frameworks and guidelines by government agencies further supports the railway sector in implementing effective security measures. As a result, railway operators are increasingly adopting sophisticated cybersecurity solutions to comply with government mandates, thereby propelling the market forward. The emphasis on national security and infrastructure resilience underscores the importance of a robust cybersecurity posture in the railway industry.

Rising Public Awareness and Expectations

Public awareness regarding cybersecurity threats has risen significantly in Germany, influencing the railway cybersecurity market. As incidents of cyberattacks gain media attention, passengers and stakeholders are increasingly concerned about the safety and security of railway systems. This heightened awareness is prompting railway operators to prioritize cybersecurity investments to meet public expectations. Surveys indicate that over 60% of passengers consider cybersecurity a crucial factor in their travel decisions. In response, railway companies are enhancing their cybersecurity frameworks to build trust and ensure passenger safety. This shift in public perception is likely to drive growth in the railway cybersecurity market, as operators seek to align their security measures with the expectations of an informed and vigilant public.

Increased Digitalization of Railway Operations

The ongoing digitalization of railway operations in Germany is a significant driver of the railway cybersecurity market. As railway companies increasingly adopt digital platforms for ticketing, scheduling, and maintenance, the attack surface for cyber threats expands. This digital transformation necessitates the implementation of robust cybersecurity measures to protect sensitive data and ensure operational continuity. Reports indicate that over 70% of railway operators are prioritizing cybersecurity investments to mitigate risks associated with digitalization. Consequently, the railway cybersecurity market is expected to witness substantial growth, with estimates suggesting an increase in market size by approximately €200 million by 2028. This trend highlights the critical need for comprehensive cybersecurity strategies in the face of evolving digital threats.