Increased Health Awareness

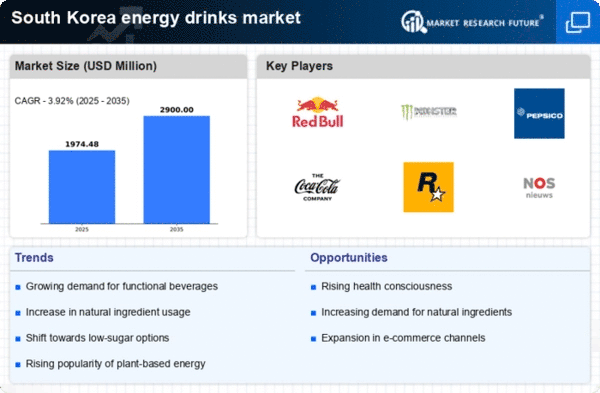

The energy drinks market in South Korea is experiencing a shift as consumers become more health-conscious. There is a growing awareness of the potential health risks associated with excessive caffeine and sugar consumption. As a result, many consumers are seeking alternatives that offer lower sugar content and natural ingredients. This trend is prompting brands within the energy drinks market to reformulate their products to meet these demands. In 2025, it is estimated that products labeled as 'low-sugar' or 'natural' will account for approximately 40% of total sales, indicating a significant shift in consumer preferences towards healthier options.

Innovative Marketing Strategies

The energy drinks market in South Korea is witnessing a transformation driven by innovative marketing strategies. Brands are leveraging social media platforms and influencer partnerships to engage with consumers more effectively. This approach not only enhances brand visibility but also fosters a sense of community among consumers. In 2025, it is projected that digital marketing expenditures in the energy drinks market will increase by 25%, reflecting the shift towards online engagement. Companies are also focusing on experiential marketing, creating events and promotions that allow consumers to interact with the brand in immersive ways, thereby strengthening brand loyalty.

Expansion of Distribution Channels

The energy drinks market in South Korea is benefiting from the expansion of distribution channels. Retailers are increasingly recognizing the potential of energy drinks and are dedicating more shelf space to these products. Additionally, the rise of convenience stores and online platforms is facilitating easier access for consumers. In 2025, it is projected that online sales will account for around 20% of total energy drinks market sales, reflecting the growing trend of e-commerce. The energy drinks market is responding by enhancing its distribution strategies to ensure that products are readily available to consumers, thereby driving overall market growth.

Youth Culture and Lifestyle Trends

The energy drinks market in South Korea is significantly influenced by the lifestyle choices of the youth demographic. Young consumers, particularly those aged 18-30, are increasingly drawn to energy drinks as part of their active and social lifestyles. This demographic is known for its preference for convenience and on-the-go consumption, which aligns with the portable nature of energy drinks. In 2025, it is estimated that this age group contributes to over 50% of the total market share. The energy drinks market is capitalizing on this trend by launching targeted marketing campaigns and product lines that resonate with the aspirations and preferences of younger consumers.

Rising Demand for Functional Beverages

The energy drinks market in South Korea experiences a notable surge in demand for functional beverages. Consumers increasingly seek products that offer more than just energy, such as enhanced cognitive function, improved physical performance, and added vitamins. This trend is reflected in the market's growth, with functional energy drinks accounting for approximately 30% of total sales in 2025. The energy drinks market is adapting to these preferences by introducing innovative formulations that cater to health-conscious consumers. As a result, brands are investing in research and development to create products that align with the evolving consumer expectations, thereby driving market expansion.