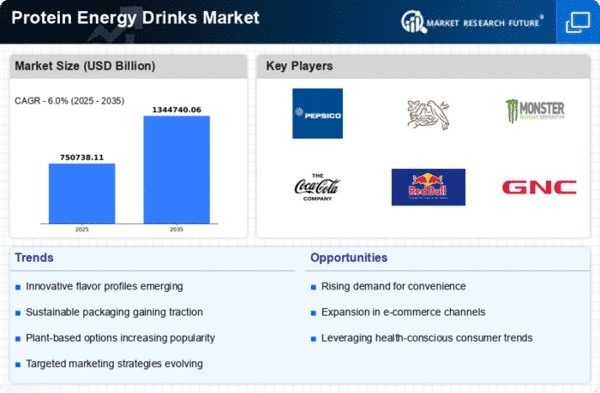

Market Growth Projections

The Global Protein energy drinks Market Industry is projected to witness substantial growth, with estimates indicating a rise from 48.5 USD Billion in 2024 to 91.1 USD Billion by 2035. This trajectory suggests a compound annual growth rate of 5.9% from 2025 to 2035, reflecting the increasing consumer inclination towards protein-enriched beverages. The market dynamics are influenced by various factors, including health trends, product innovation, and changing consumer lifestyles. As the industry adapts to these evolving preferences, it is likely to attract new entrants and foster competition, ultimately benefiting consumers with a wider array of choices.

Rising Health Consciousness

The Global Protein Energy Drinks Market Industry experiences a notable surge in demand driven by increasing health consciousness among consumers. Individuals are progressively seeking nutritious alternatives to traditional beverages, favoring products that offer protein enrichment. This trend is particularly evident among fitness enthusiasts and health-conscious individuals who prioritize protein intake for muscle recovery and overall wellness. As a result, the market is projected to reach 48.5 USD Billion in 2024, reflecting a growing preference for functional beverages that align with healthier lifestyles. The shift towards protein-rich diets is likely to propel the industry further, indicating a sustained growth trajectory.

Innovative Product Offerings

Innovation plays a critical role in the Global Protein Energy Drinks Market Industry, as manufacturers continuously develop new formulations to meet evolving consumer demands. The introduction of plant-based protein options, functional ingredients, and unique flavor profiles caters to a broader audience, including those with dietary restrictions. For instance, the rise of veganism and lactose intolerance has prompted brands to create dairy-free protein drinks, appealing to a niche market. This focus on innovation not only attracts new consumers but also retains existing ones, contributing to the market's projected growth to 91.1 USD Billion by 2035. The emphasis on product differentiation is likely to remain a key driver.

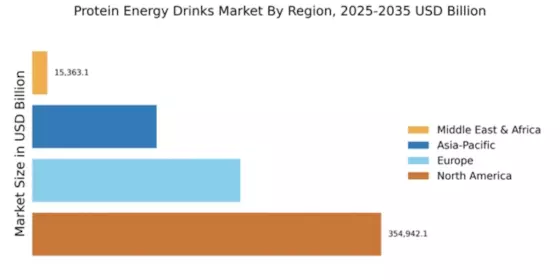

Expansion of Distribution Channels

The Global Protein Energy Drinks Market Industry benefits from the expansion of distribution channels, which enhances product accessibility for consumers. Retailers are increasingly adopting omnichannel strategies, integrating online and offline platforms to cater to diverse consumer preferences. This expansion includes partnerships with e-commerce platforms, supermarkets, and convenience stores, facilitating wider reach. As consumers seek convenience in purchasing, the availability of protein energy drinks through various channels is likely to bolster sales. The growing trend of online shopping, particularly among younger demographics, suggests that the industry could see significant growth as it adapts to changing consumer behaviors.

Growing Demand for Convenience Foods

The Global Protein Energy Drinks Market Industry is experiencing growth due to the increasing demand for convenience foods. Busy lifestyles and the need for on-the-go nutrition have led consumers to seek quick and easy meal replacements, with protein energy drinks emerging as a popular choice. These beverages offer a convenient source of protein without the need for preparation, appealing to working professionals and active individuals. The trend towards convenience is likely to persist, driving innovation in packaging and formulation to enhance portability. As the market evolves, the focus on convenience is expected to play a pivotal role in shaping consumer preferences and driving sales.

Increased Participation in Sports and Fitness Activities

The Global Protein Energy Drinks Market Industry is significantly influenced by the rising participation in sports and fitness activities. As more individuals engage in regular exercise, the demand for protein supplements to support muscle recovery and performance enhancement escalates. This trend is particularly pronounced among millennials and Generation Z, who prioritize fitness and wellness. The increasing awareness of the benefits of protein consumption in relation to physical activity is likely to drive sales in the industry. With a projected compound annual growth rate of 5.9% from 2025 to 2035, the market is poised for substantial growth as fitness culture continues to thrive globally.