Rising Healthcare Expenditure

The increase in healthcare expenditure across South America is contributing to the expansion of the non invasive-prenatal-testing market. As countries in the region allocate more resources to healthcare, there is a corresponding rise in the availability of advanced medical technologies, including non invasive prenatal tests. Reports indicate that healthcare spending in South America is expected to grow by 10% annually, which could lead to greater investment in prenatal care services. This trend suggests that more healthcare facilities will adopt non invasive testing methods, making them more accessible to expectant parents. Consequently, the non invasive-prenatal-testing market is likely to benefit from this upward trajectory in healthcare investment.

Government Initiatives and Funding

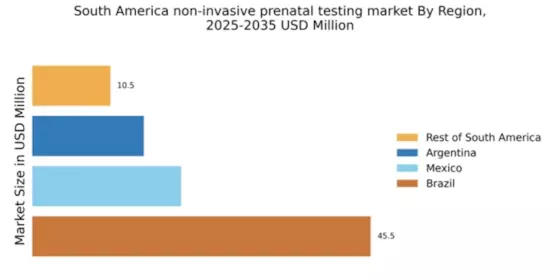

Government initiatives aimed at improving maternal and child health are playing a pivotal role in the non invasive-prenatal-testing market in South America. Various countries in the region are implementing policies that promote access to prenatal care, including non invasive testing options. Increased funding for maternal health programs is expected to enhance the availability of these tests in public healthcare systems. For instance, Brazil has allocated approximately $200 million to improve prenatal care services, which includes the integration of non invasive testing. Such initiatives are likely to increase awareness and accessibility, thereby driving the growth of the non invasive-prenatal-testing market.

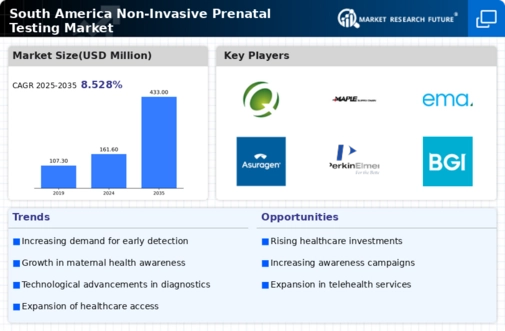

Increasing Demand for Early Detection

The rising demand for early detection of genetic disorders is a key driver in the non invasive-prenatal-testing market in South America. Expectant parents are increasingly seeking non invasive methods to assess the health of their unborn children. This trend is reflected in the growing number of prenatal tests conducted, with estimates suggesting that the market could reach a valuation of $500 million by 2027. The emphasis on early diagnosis is likely to enhance the adoption of non invasive testing methods, as they offer a safer alternative to invasive procedures. Furthermore, the increasing prevalence of genetic disorders in the region has heightened the need for effective screening solutions, thereby propelling the growth of the non invasive-prenatal-testing market.

Advancements in Genetic Testing Technologies

Technological innovations in genetic testing are significantly influencing the non invasive-prenatal-testing market in South America. The introduction of next-generation sequencing (NGS) and improved bioinformatics tools has enhanced the accuracy and efficiency of prenatal tests. These advancements have led to a reduction in false positive rates, which is crucial for gaining the trust of healthcare providers and patients alike. As a result, the market is projected to grow at a CAGR of 15% over the next five years. The ability to analyze cell-free fetal DNA with greater precision is likely to drive the adoption of non invasive testing methods, making them more appealing to expectant parents concerned about the health of their babies.

Cultural Shifts Towards Preventive Healthcare

Cultural shifts towards preventive healthcare are influencing the non invasive-prenatal-testing market in South America. There is a growing recognition among the population of the importance of proactive health measures, particularly during pregnancy. This shift is reflected in the increasing number of expectant parents opting for non invasive prenatal tests as a means of ensuring the health of their unborn children. Surveys indicate that approximately 60% of pregnant women in urban areas are now aware of non invasive testing options. This heightened awareness is likely to drive demand, as more individuals seek to utilize these tests for early detection of potential health issues, thereby fostering growth in the non invasive-prenatal-testing market.