Aging Population

The demographic shift towards an aging population in South America significantly influences the health insurance market. By 2025, it is estimated that individuals aged 65 and older will constitute over 10% of the total population, leading to increased demand for healthcare services. This demographic trend necessitates comprehensive health insurance solutions tailored to the unique needs of older adults, including chronic disease management and long-term care. As the health insurance market adapts to this demographic reality, insurers may develop specialized products that cater to the aging population, thereby enhancing their market presence and ensuring sustainability in a competitive landscape.

Regulatory Environment

The regulatory environment in South America plays a crucial role in shaping the health insurance market. Recent reforms aimed at increasing access to healthcare and improving the quality of services are influencing how insurers operate. For instance, new regulations may mandate minimum coverage standards, impacting premium pricing and policy structures. As of 2025, it is expected that compliance with these regulations will require insurers to enhance their operational frameworks, potentially leading to increased costs. However, these changes also present opportunities for growth within the health insurance market, as companies that adapt effectively may gain a competitive edge in a rapidly evolving landscape.

Rising Healthcare Costs

The health insurance market in South America is experiencing upward pressure due to escalating healthcare costs. Factors such as increased demand for advanced medical technologies and rising prices for pharmaceuticals contribute to this trend. In 2025, healthcare expenditure in the region is projected to reach approximately $1.5 trillion, reflecting a growth rate of around 8% annually. This surge in costs necessitates a robust health insurance market to mitigate financial burdens on individuals and families. Insurers are compelled to adapt their offerings, ensuring that coverage remains accessible while addressing the financial realities of healthcare. Consequently, the health insurance market is likely to see innovations in policy structures and premium adjustments to accommodate these rising costs.

Increased Health Awareness

There is a notable rise in health awareness among the South American population, which is influencing the health insurance market. As individuals become more informed about health issues and preventive care, there is a growing demand for insurance products that emphasize wellness and preventive services. Surveys indicate that approximately 60% of consumers in the region are now prioritizing health insurance plans that offer preventive care benefits. This shift is prompting insurers to innovate their product offerings, integrating wellness programs and incentives for healthy behaviors. Consequently, the health insurance market is evolving to meet these changing consumer preferences, fostering a culture of health and prevention.

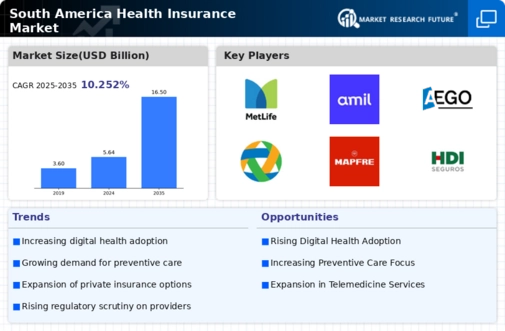

Technological Advancements

Technological advancements are reshaping the health insurance market in South America, driving efficiency and improving service delivery. The integration of telemedicine, artificial intelligence, and data analytics is becoming increasingly prevalent, allowing insurers to streamline operations and enhance customer experiences. In 2025, it is anticipated that over 30% of health insurance providers will adopt telehealth services, reflecting a shift towards more accessible healthcare solutions. This trend not only improves patient engagement but also reduces operational costs for insurers. As a result, the health insurance market is likely to witness a transformation in how services are delivered, with technology playing a pivotal role in shaping future offerings.