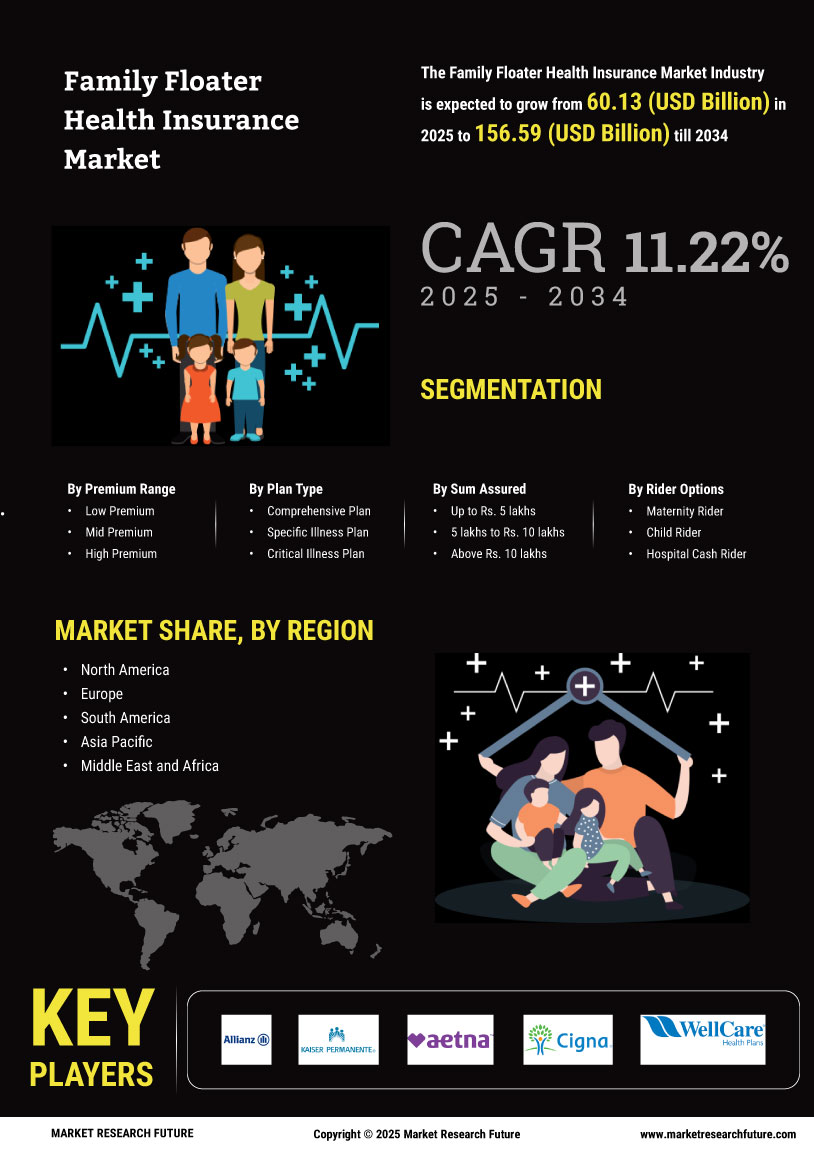

Rising Healthcare Costs

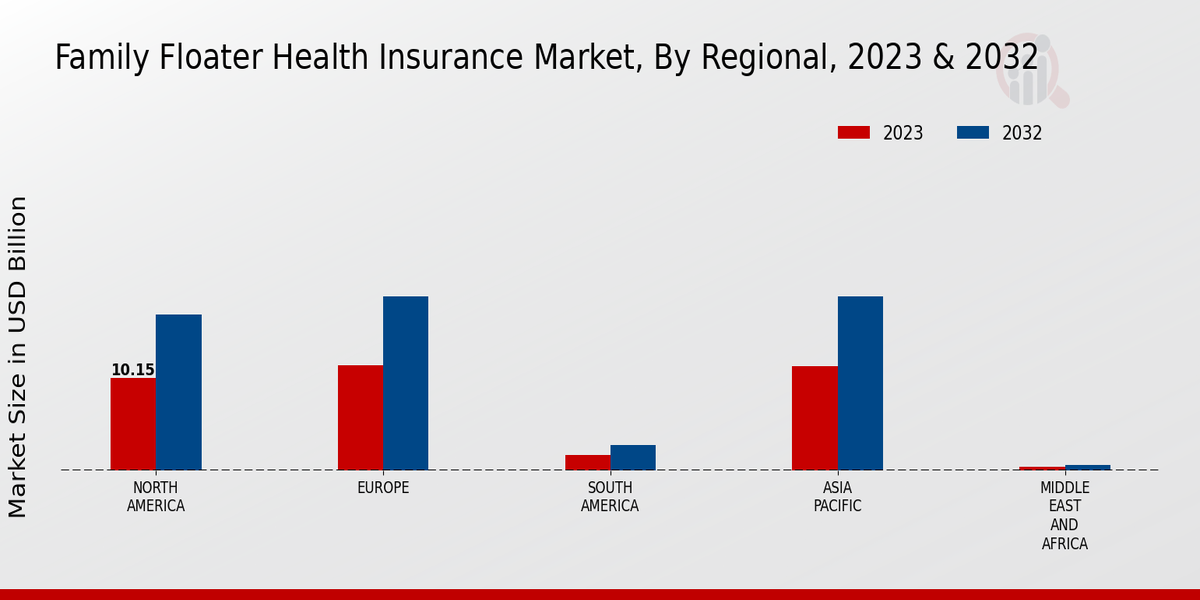

The escalating costs associated with healthcare services are a primary driver for the Family Floater Health Insurance Market. As medical expenses continue to rise, families are increasingly seeking comprehensive insurance solutions to mitigate financial burdens. Reports indicate that healthcare expenditure has been growing at an annual rate of approximately 5-7 percent, prompting families to consider family floater plans as a cost-effective alternative to individual policies. This trend is particularly evident in regions where healthcare inflation outpaces general inflation, leading to a heightened awareness of the need for adequate health coverage. Consequently, the Family Floater Health Insurance Market is likely to experience robust growth as families prioritize financial security against unforeseen medical expenses.

Increased Awareness of Health Risks

The growing awareness of health risks and the importance of health insurance is significantly influencing the Family Floater Health Insurance Market. With rising incidences of chronic diseases and lifestyle-related health issues, families are becoming more proactive in securing health coverage. Data suggests that nearly 60 percent of individuals are now aware of the benefits of family floater plans, which provide coverage for multiple family members under a single policy. This awareness is further fueled by health campaigns and educational initiatives that emphasize the necessity of insurance in managing health risks. As a result, the Family Floater Health Insurance Market is poised for expansion as families seek to protect their loved ones from potential health crises.

Shift Towards Preventive Healthcare

The shift towards preventive healthcare is significantly impacting the Family Floater Health Insurance Market. Families are increasingly recognizing the value of preventive measures, such as regular health check-ups and wellness programs, in maintaining overall health. This trend is reflected in the growing demand for insurance plans that offer coverage for preventive services, which can help reduce long-term healthcare costs. Insurers are responding by incorporating wellness incentives and preventive care benefits into family floater policies, thereby attracting health-conscious consumers. As awareness of preventive healthcare continues to rise, the Family Floater Health Insurance Market is likely to expand, catering to families seeking comprehensive coverage that promotes health and well-being.

Government Initiatives and Regulations

Government initiatives aimed at promoting health insurance coverage are playing a crucial role in shaping the Family Floater Health Insurance Market. Various countries have implemented policies to encourage families to obtain health insurance, including tax benefits and subsidies for low-income households. For instance, some regions have introduced mandatory health insurance laws, which have led to an increase in policy uptake. These regulatory frameworks not only enhance accessibility but also foster a competitive environment among insurers, driving innovation in policy offerings. Consequently, the Family Floater Health Insurance Market is likely to benefit from these supportive measures, as more families are incentivized to secure comprehensive health coverage.

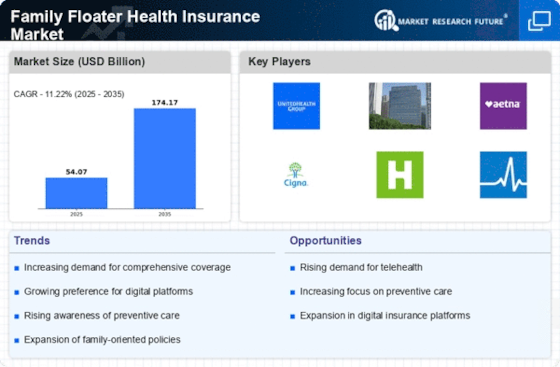

Technological Advancements in Insurance

Technological advancements are revolutionizing the Family Floater Health Insurance Market by enhancing customer experience and streamlining processes. The integration of digital platforms allows families to compare policies, manage claims, and access health services more efficiently. Innovations such as telemedicine and mobile health applications are becoming increasingly popular, providing families with convenient access to healthcare resources. Furthermore, data analytics enables insurers to tailor policies to meet specific family needs, thereby improving customer satisfaction. As technology continues to evolve, the Family Floater Health Insurance Market is expected to witness increased engagement from tech-savvy consumers seeking modern solutions to their health insurance requirements.

Leave a Comment