Collaboration with Local Tech Startups

The federal edge-computing market in South America is witnessing a growing trend of collaboration between government agencies and local tech startups. These partnerships are aimed at fostering innovation and developing tailored edge computing solutions that address specific regional challenges. By leveraging the agility and creativity of startups, government entities can implement cutting-edge technologies more effectively. It is anticipated that such collaborations could lead to a 30% increase in the adoption of edge computing solutions within the next three years. This dynamic interaction not only enhances the capabilities of the federal edge-computing market but also stimulates economic growth and technological advancement in the region.

Increased Focus on Cybersecurity Measures

The federal edge-computing market in South America is increasingly shaped by a heightened focus on cybersecurity measures. As government agencies adopt edge computing technologies, the potential vulnerabilities associated with data transmission and processing at the edge become a critical concern. In response, agencies are likely to invest in advanced cybersecurity solutions to protect sensitive information. It is estimated that spending on cybersecurity in the region could reach $5 billion by 2026, reflecting the urgent need for robust security frameworks. This emphasis on cybersecurity not only safeguards data integrity but also fosters trust in the federal edge-computing market, encouraging further adoption of edge technologies.

Expansion of IoT Applications in Government

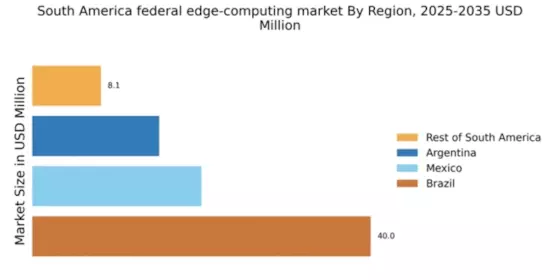

The proliferation of Internet of Things (IoT) applications within government operations is a key driver for the federal edge-computing market in South America. As agencies increasingly deploy IoT devices for monitoring and data collection, the need for efficient data processing at the edge becomes apparent. This trend is likely to enhance operational capabilities in areas such as environmental monitoring, transportation management, and public health. Projections suggest that the number of connected IoT devices in government sectors could exceed 1 billion by 2028. This expansion presents a substantial opportunity for the federal edge-computing market to provide the necessary infrastructure and solutions to support these applications.

Rising Demand for Real-Time Data Processing

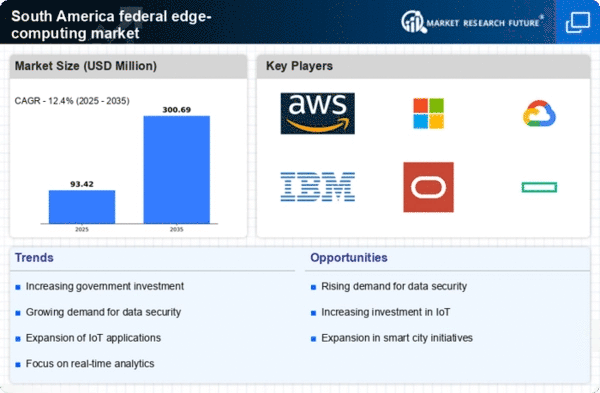

The federal edge-computing market in South America experiences a notable surge in demand for real-time data processing capabilities. This demand is driven by the increasing need for timely decision-making in various sectors, including defense, public safety, and emergency response. As government agencies seek to enhance operational efficiency, the integration of edge computing solutions allows for faster data analysis and response times. Reports indicate that the market for edge computing in South America is projected to grow at a CAGR of approximately 25% over the next five years. This growth reflects the urgency for agencies to leverage data analytics at the edge, thereby improving service delivery and operational effectiveness in the federal edge-computing market.

Government Initiatives for Digital Transformation

In South America, government initiatives aimed at digital transformation significantly influence the federal edge-computing market. Various national strategies emphasize the modernization of public services through technology adoption. For instance, initiatives promoting smart cities and enhanced connectivity are likely to drive the deployment of edge computing solutions. These efforts are expected to result in an investment of over $1 billion in digital infrastructure by 2027. Such investments not only facilitate improved data management but also enhance the overall efficiency of government operations. Consequently, the federal edge-computing market stands to benefit from these transformative policies, which aim to create a more responsive and efficient public sector.