Cost Efficiency and Resource Optimization

Cost efficiency and resource optimization are emerging as significant drivers in the federal edge-computing market. Federal agencies are under constant pressure to maximize their budgets while improving service delivery. Edge computing offers a solution by reducing the need for extensive data transmission to centralized data centers, which can be costly and time-consuming. By processing data closer to the source, agencies can lower operational costs and optimize resource allocation. Recent analyses indicate that federal investments in edge computing could lead to savings of up to 20% in IT expenditures over the next few years. This potential for cost reduction, coupled with improved performance, positions edge computing as a strategic priority for federal agencies.

Regulatory Compliance and Data Sovereignty

The federal edge-computing market is significantly influenced by regulatory compliance and data sovereignty requirements. Federal agencies must adhere to strict regulations regarding data handling, storage, and processing, particularly when dealing with sensitive information. Edge computing solutions can facilitate compliance by enabling data to be processed and stored within specific geographic boundaries, thus addressing concerns related to data sovereignty. As agencies increasingly adopt edge computing technologies, they are likely to invest in solutions that align with federal regulations, which could account for approximately 30% of their IT budgets. This focus on compliance not only enhances security but also fosters trust in federal operations, making it a crucial driver in the market.

Enhanced Network Reliability and Resilience

In the context of the federal edge-computing market, the emphasis on network reliability and resilience is becoming increasingly critical. Federal agencies are tasked with ensuring uninterrupted service delivery, especially in mission-critical operations. Edge computing provides a decentralized approach that enhances network reliability by distributing data processing across multiple nodes. This architecture minimizes the risk of single points of failure, which is essential for maintaining operational continuity. Recent reports indicate that investments in edge computing infrastructure are expected to reach $10 billion by 2026, as agencies prioritize robust solutions that can withstand cyber threats and natural disasters. The focus on resilience is likely to drive further innovation in the federal edge-computing market.

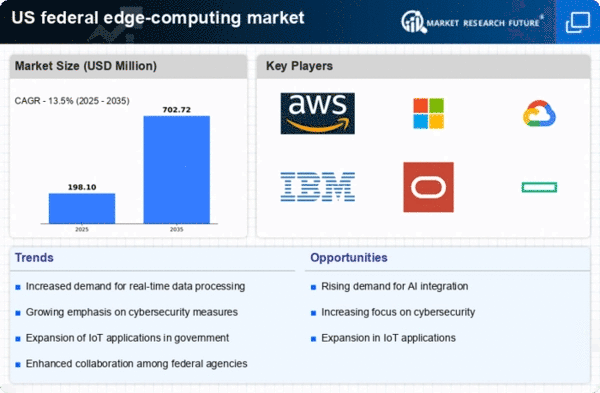

Rising Demand for Real-Time Data Processing

The federal edge-computing market is experiencing a notable surge in demand for real-time data processing capabilities. This trend is largely driven by the increasing need for timely decision-making in various federal operations, including defense, intelligence, and public safety. As agencies seek to enhance operational efficiency, the integration of edge computing solutions allows for data to be processed closer to the source, thereby reducing latency. According to recent estimates, the market for edge computing in federal applications is projected to grow at a CAGR of approximately 25% over the next five years. This growth reflects the urgency for federal entities to leverage data analytics and improve responsiveness, ultimately transforming how they operate in a data-driven environment.

Integration of IoT Devices in Federal Operations

The integration of Internet of Things (IoT) devices within federal operations is a pivotal driver for the federal edge-computing market. As agencies deploy IoT technologies for various applications, including surveillance, environmental monitoring, and asset tracking, the need for efficient data processing at the edge becomes paramount. Edge computing enables these devices to process data locally, reducing bandwidth usage and improving response times. Current estimates suggest that the number of IoT devices used by federal agencies could exceed 1 billion by 2027, creating a substantial demand for edge computing solutions. This integration not only enhances operational efficiency but also supports the development of smart federal infrastructures, thereby propelling the market forward.