Aging Population

The demographic shift towards an aging population in South America is significantly influencing the dietary supplements market. As the population ages, there is a growing need for products that cater to the health concerns of older adults, such as joint health, cognitive function, and cardiovascular support. This demographic is increasingly seeking dietary supplements that can help mitigate age-related health issues. Market data suggests that the segment targeting seniors is expected to account for a substantial share of the overall market, with an anticipated growth rate of around 10% in the coming years. This trend indicates a strong potential for companies to develop specialized products aimed at this demographic, thereby driving the dietary supplements market.

E-commerce Expansion

The dietary supplements market in South America is being propelled by the rapid expansion of e-commerce platforms. With the increasing penetration of the internet and mobile devices, consumers are increasingly turning to online shopping for dietary supplements. This shift not only provides convenience but also offers access to a wider range of products and brands. Recent statistics indicate that online sales of dietary supplements have surged by over 30% in the past year, reflecting a significant change in consumer purchasing behavior. As e-commerce continues to grow, it is likely to play a crucial role in shaping the dietary supplements market, enabling brands to reach a broader audience and enhance their market presence.

Rising Disposable Income

The dietary supplements market in South America is benefiting from an increase in disposable income among consumers. As economic conditions improve, individuals are more willing to spend on health and wellness products, including dietary supplements. This trend is particularly evident in urban areas where consumers are increasingly prioritizing health and nutrition. Market analysis indicates that the premium segment of dietary supplements is experiencing notable growth, with consumers willing to pay more for high-quality, effective products. This shift in spending habits is expected to drive the overall market, as more individuals invest in dietary supplements to enhance their health and well-being.

Influence of Social Media

The dietary supplements market in South America is significantly influenced by the rise of social media and digital marketing. Platforms such as Instagram and Facebook have become vital channels for brands to engage with consumers and promote their products. Influencers and health advocates play a crucial role in shaping consumer perceptions and driving demand for dietary supplements. Recent surveys indicate that nearly 60% of consumers in South America are influenced by social media when making purchasing decisions related to health products. This trend suggests that effective digital marketing strategies could enhance brand visibility and consumer trust, thereby propelling the dietary supplements market forward.

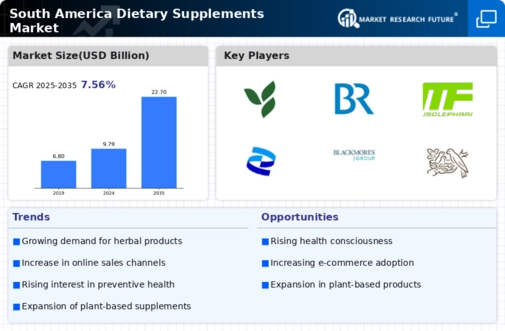

Increasing Health Awareness

The dietary supplements market in South America is experiencing growth driven by a rising awareness of health and wellness among consumers. As individuals become more informed about nutrition and its impact on overall health, there is a noticeable shift towards preventive healthcare. This trend is reflected in the increasing demand for dietary supplements that support various health goals, such as weight management, enhanced energy levels, and improved immune function. According to recent data, the market is projected to grow at a CAGR of approximately 8% over the next five years, indicating a robust interest in health-oriented products. This heightened awareness is likely to encourage consumers to invest in dietary supplements, thereby expanding the market further.