Rising Demand for Scalability

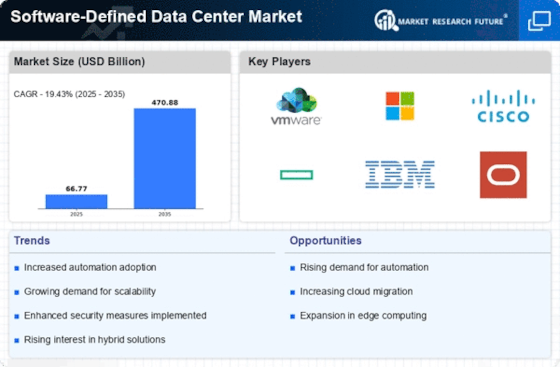

The Software-Defined Data Center Market is experiencing a notable surge in demand for scalability. Organizations are increasingly seeking solutions that allow them to scale their IT resources dynamically, responding to fluctuating workloads and business needs. This trend is driven by the necessity for businesses to remain agile in a competitive landscape. According to recent data, the market for scalable solutions is projected to grow at a compound annual growth rate of approximately 25% over the next five years. As enterprises migrate to software-defined architectures, they are finding that these solutions not only enhance operational efficiency but also reduce costs associated with over-provisioning. The ability to scale resources on-demand is becoming a critical factor in the decision-making process for IT investments.

Enhanced Operational Efficiency

Operational efficiency remains a pivotal driver within the Software-Defined Data Center Market. Organizations are increasingly adopting software-defined solutions to streamline their operations, reduce manual intervention, and optimize resource utilization. By automating routine tasks and leveraging orchestration tools, companies can achieve significant improvements in efficiency. Recent studies indicate that businesses utilizing software-defined data centers report up to a 40% reduction in operational costs. This efficiency is particularly crucial as organizations strive to maximize their return on investment in IT infrastructure. Furthermore, the integration of advanced analytics within these environments allows for better decision-making and resource allocation, further enhancing overall operational performance.

Growing Focus on Cost Reduction

Cost reduction is a fundamental driver influencing the Software-Defined Data Center Market. As organizations face increasing pressure to optimize their IT budgets, software-defined solutions offer a pathway to significant savings. By consolidating hardware and utilizing virtualization technologies, companies can reduce capital expenditures and operational costs. Market analysis suggests that organizations can achieve up to 30% savings in IT spending by transitioning to software-defined architectures. This financial incentive is compelling, particularly for small to medium-sized enterprises that may have limited resources. Additionally, the ability to leverage existing infrastructure while adopting new technologies further enhances the cost-effectiveness of software-defined data centers.

Increased Emphasis on Data Security

Data security is becoming an increasingly critical concern within the Software-Defined Data Center Market. As cyber threats evolve, organizations are prioritizing the implementation of robust security measures within their data center environments. Software-defined solutions offer enhanced security features, such as micro-segmentation and automated compliance checks, which help mitigate risks. Recent reports indicate that the market for security solutions in software-defined environments is expected to grow by over 20% in the coming years. This emphasis on security not only protects sensitive data but also ensures compliance with regulatory requirements, making it a vital consideration for organizations looking to adopt software-defined architectures.

Adoption of Artificial Intelligence and Machine Learning

The integration of artificial intelligence (AI) and machine learning (ML) technologies is emerging as a significant driver in the Software-Defined Data Center Market. These technologies enable organizations to analyze vast amounts of data, optimize resource allocation, and predict future workloads. By leveraging AI and ML, businesses can enhance their operational capabilities and improve decision-making processes. Current trends suggest that the adoption of AI-driven solutions within software-defined data centers could increase by approximately 35% over the next few years. This shift not only enhances efficiency but also positions organizations to better respond to market demands and technological advancements.