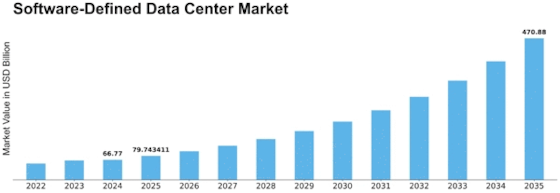

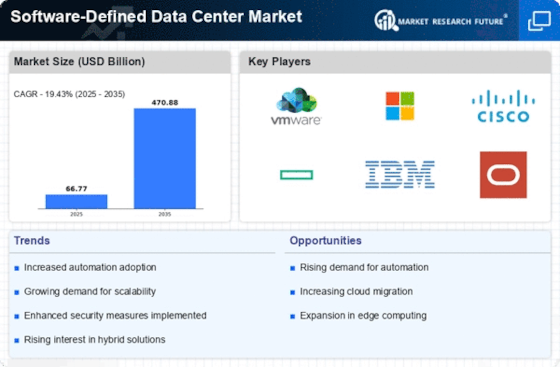

Software Defined Data Center Size

Software Defined Data Center Market Growth Projections and Opportunities

The Software-Defined Data Center (SDDC) Market is growing rapidly, and companies are positioning themselves to gain market share. Industry players use separation. Organizations emphasize advanced SDDC features including virtualization, automation, and coordination. VMware and Microsoft intend to attract businesses seeking innovative and flexible SDDC solutions by providing a comprehensive and adaptable base that meets changing business demands, giving them a market advantage.

Another essential Software-Defined Data Center Market strategy is cost initiative. Companies provide feasible SDDC solutions to make them more accessible to a wide variety of organizations, especially those with financial plan needs. Streamlining asset utilization, using open-source technologies, and providing flexible permission methods are part of this approach. Organizations may attract more customers and establish key strengths by positioning themselves as cost-effective alternatives. This is particularly important in areas where cost considerations strongly influence IT framework investment decisions.

Market division is crucial for Software-Defined Data Center Market companies to meet industry demands. Dissecting the requirements of sectors like money, medical services, and broadcast communications allows firms to tailor SDDC contributions to unique consistency principles and functional issues. Under specific agreements, Dell Technologies and Nutanix provide specialist markets within the SDDC sector, meeting the needs of distinct corporations.

Software-Defined Data Center Market share depends on key companies and coordinated efforts. SDDC arrangements may be improved by working with equipment manufacturers, cloud specialist co-ops, and other technology suppliers. Cisco and SDDC providers collaborate to integrate software-defined innovations into system administration and framework elements, providing customers with a complete and interoperable data center setup.

Companies seeking to grow in the Software-Defined Data Center Market must develop globally. With global enterprises, SDDC arrangements that can adapt to data residency and administrative requirements are in demand. HPE and IBM focus on global expansion to service global projects, allowing them to provide predictable and adaptive software-defined framework across regions.

Mechanical development leads Software-Defined Data Center Market share positioning. Organizations become industry leaders by coordinating computerized reasoning for computerization, performing edge registering skills, or expanding security features. Continuous innovation allows companies to deliver cutting-edge solutions that fulfill the framework demands of software-defined design companies.

Leave a Comment