Rising Demand for Scalability

The software defined-data-center market is experiencing a notable increase in demand for scalability solutions. Organizations in the GCC are increasingly seeking flexible infrastructure that can adapt to fluctuating workloads. This trend is driven by the need for businesses to respond swiftly to market changes and customer demands. According to recent data, the GCC region is projected to witness a CAGR of approximately 15% in the software defined-data-center market over the next five years. This growth is indicative of the region's commitment to enhancing its IT capabilities, allowing enterprises to scale their operations efficiently without incurring significant capital expenditures. As a result, the software defined-data-center market is becoming a critical component for organizations aiming to maintain competitive advantages in a rapidly evolving digital landscape.

Growing Focus on Data Sovereignty

Data sovereignty is becoming an essential consideration for organizations operating within the GCC, thereby impacting the software defined-data-center market. As data protection regulations become more stringent, businesses are compelled to ensure that their data remains within national borders. This focus on compliance is driving the demand for localized data centers that adhere to regional laws and regulations. The software defined-data-center market is adapting to this need by offering solutions that facilitate data residency while maintaining operational efficiency. As a result, organizations are increasingly investing in software defined-data-center technologies to ensure compliance and mitigate risks associated with data breaches. This trend is likely to shape the future landscape of the software defined-data-center market in the GCC.

Enhanced Disaster Recovery Solutions

The need for robust disaster recovery solutions is a critical driver in the software defined-data-center market. Organizations in the GCC are recognizing the importance of ensuring business continuity in the face of potential disruptions. The software defined-data-center market offers advanced disaster recovery capabilities that allow businesses to quickly recover from unforeseen events. With the ability to replicate data across multiple locations, organizations can minimize downtime and safeguard their operations. Recent studies indicate that companies utilizing software defined-data-center solutions for disaster recovery can reduce recovery time objectives (RTO) by up to 50%. This capability is increasingly appealing to businesses that prioritize resilience and reliability, thereby driving the growth of the software defined-data-center market in the region.

Integration of Advanced Technologies

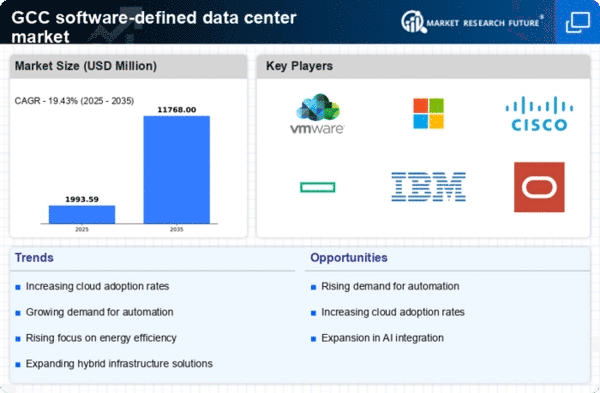

The integration of advanced technologies is significantly influencing the software defined-data-center market. Innovations such as artificial intelligence (AI), machine learning (ML), and Internet of Things (IoT) are being increasingly incorporated into data center operations. This integration enhances automation, improves decision-making processes, and optimizes resource management. In the GCC, the software defined-data-center market is expected to benefit from these technological advancements, with a projected increase in market size by 20% over the next few years. The ability to leverage these technologies allows organizations to streamline their operations, reduce downtime, and enhance overall performance. Consequently, the software defined-data-center market is positioned to play a crucial role in the digital transformation journey of businesses in the region.

Cost Efficiency and Resource Optimization

Cost efficiency remains a pivotal driver in the software defined-data-center market. Organizations in the GCC are increasingly focused on optimizing their IT expenditures while maximizing resource utilization. The shift towards software-defined architectures allows for better allocation of resources, reducing operational costs by up to 30%. This financial incentive is particularly appealing to businesses looking to enhance their profitability in a competitive environment. Furthermore, the software defined-data-center market enables organizations to consolidate their data center operations, leading to lower energy consumption and maintenance costs. As companies strive to achieve operational excellence, the emphasis on cost efficiency is likely to propel the adoption of software defined-data-center solutions across various sectors in the GCC.