North America : Innovation Hub for Smart Workplaces

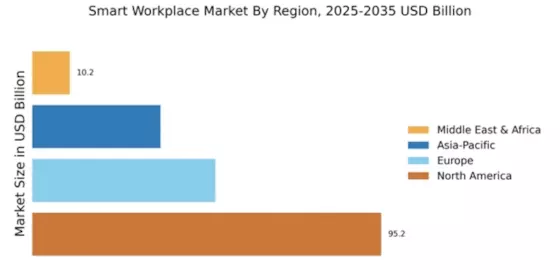

North America continues to dominate the Smart Workplace Market, holding a significant market share of 95.24 in 2024. The region's growth is driven by rapid technological advancements, increased remote work adoption, and a strong focus on sustainability. Regulatory support for smart technologies and investments in digital infrastructure further catalyze market expansion. Companies are increasingly seeking integrated solutions to enhance productivity and employee satisfaction, making this region a hotbed for innovation. The competitive landscape in North America is robust, featuring key players such as Cisco Systems, Microsoft, and IBM. These companies are at the forefront of developing cutting-edge solutions that cater to diverse workplace needs. The U.S. leads the charge, with Canada and Mexico also contributing to the market's growth. The presence of major tech firms and a favorable business environment solidify North America's position as a leader in the Smart Workplace sector.

Europe : Emerging Powerhouse in Smart Solutions

Europe is witnessing a significant transformation in the Smart Workplace Market, with a market size of 50.0 in 2024. The region's growth is fueled by increasing investments in smart technologies, a shift towards hybrid work models, and stringent regulations promoting energy efficiency. European governments are actively supporting initiatives that enhance workplace productivity and sustainability, creating a favorable environment for market expansion. Leading countries such as Germany, France, and the UK are at the forefront of this evolution, with major players like Siemens and Schneider Electric driving innovation. The competitive landscape is characterized by a mix of established firms and emerging startups, all vying for a share of the growing market. The European Union's commitment to digital transformation and sustainability further enhances the region's attractiveness for smart workplace solutions.

Asia-Pacific : Rapidly Growing Market Potential

The Asia-Pacific region is rapidly emerging as a key player in the Smart Workplace Market, with a market size of 35.0 in 2024. The growth is driven by increasing urbanization, a rising middle class, and a growing emphasis on digital transformation across various industries. Governments in countries like China and India are implementing policies that encourage the adoption of smart technologies, further propelling market growth. China, Japan, and Australia are leading the charge in this region, with significant investments in smart infrastructure and workplace solutions. The competitive landscape is diverse, featuring both global giants and local innovators. Companies like Oracle and Honeywell are actively expanding their presence, catering to the unique needs of the region's workforce. The Asia-Pacific market is poised for substantial growth as businesses increasingly recognize the value of smart workplace solutions.

Middle East and Africa : Resource-Rich Frontier for Innovation

The Middle East and Africa region is gradually emerging in the Smart Workplace Market, with a market size of 10.24 in 2024. The growth is primarily driven by increasing investments in technology and infrastructure, alongside a growing awareness of the benefits of smart workplaces. Governments are beginning to recognize the importance of digital transformation, which is fostering a conducive environment for market growth. Countries like the UAE and South Africa are leading the way, with significant initiatives aimed at enhancing workplace efficiency through smart technologies. The competitive landscape is still developing, with both local and international players exploring opportunities. As the region continues to invest in smart solutions, the potential for growth in the Smart Workplace Market is substantial, making it an attractive frontier for innovation.