Integration of Advanced Technologies

The Smart Office Market is witnessing a robust integration of advanced technologies, which enhances operational efficiency and productivity. Companies are increasingly adopting smart lighting, climate control, and security systems that can be managed remotely. This trend is driven by the need for seamless connectivity and automation in office environments. According to recent data, the market for smart building technologies is projected to reach USD 100 billion by 2026, indicating a strong demand for integrated solutions. The incorporation of these technologies not only streamlines processes but also reduces energy consumption, aligning with sustainability goals. As organizations strive to create more adaptive workspaces, the integration of advanced technologies is likely to play a pivotal role in shaping the future of the Smart Office Market.

Rise of Remote Work and Hybrid Models

The shift towards remote work and hybrid models is reshaping the Smart Office Market. As organizations adapt to flexible work arrangements, there is a growing need for technologies that facilitate collaboration and communication among dispersed teams. Smart office solutions, such as virtual meeting platforms and collaborative software, are becoming essential tools for maintaining productivity in this new work environment. Data suggests that companies investing in smart office technologies can enhance employee engagement and satisfaction, which are crucial for retaining talent in a competitive job market. This trend is likely to continue, as businesses recognize the benefits of creating adaptable workspaces that cater to both in-office and remote employees. The rise of remote work is thus a significant driver influencing the evolution of the Smart Office Market.

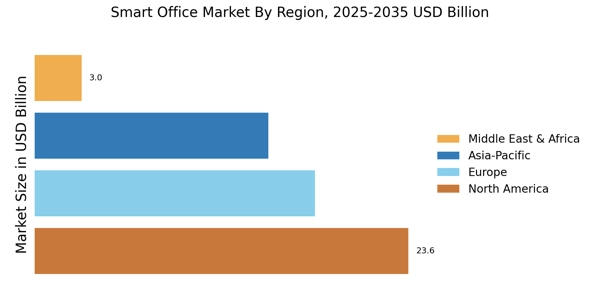

Increased Investment in Smart Infrastructure

Investment in smart infrastructure is a key driver of growth in the Smart Office Market. Organizations are allocating substantial resources to upgrade their facilities with smart technologies that enhance operational efficiency and user experience. This trend is supported by the increasing availability of funding and incentives for smart building projects. For instance, governments and private sectors are collaborating to promote smart city initiatives, which often include smart office components. The market for smart infrastructure is expected to grow at a compound annual growth rate of over 20% in the coming years, reflecting the urgency for businesses to modernize their work environments. As companies recognize the long-term benefits of investing in smart infrastructure, this driver is likely to significantly impact the Smart Office Market.

Focus on Sustainability and Energy Efficiency

Sustainability has emerged as a critical driver in the Smart Office Market, as businesses increasingly prioritize eco-friendly practices. The demand for energy-efficient solutions is on the rise, with organizations seeking to minimize their carbon footprint. Smart offices utilize energy management systems that monitor and optimize energy usage, leading to significant cost savings. Reports indicate that energy-efficient buildings can reduce energy consumption by up to 30%, which is a compelling incentive for companies to invest in smart technologies. Furthermore, regulatory frameworks are evolving to support sustainable practices, pushing organizations to adopt smart solutions that comply with environmental standards. This focus on sustainability not only enhances corporate responsibility but also appeals to environmentally conscious consumers, thereby influencing purchasing decisions in the Smart Office Market.

Growing Demand for Data-Driven Decision Making

The Smart Office Market is increasingly influenced by the demand for data-driven decision making. Organizations are leveraging data analytics to gain insights into employee behavior, space utilization, and operational efficiency. By implementing smart office technologies that collect and analyze data, companies can make informed decisions that enhance productivity and optimize resource allocation. The ability to track and analyze performance metrics is becoming essential for organizations aiming to stay competitive. Reports indicate that businesses utilizing data analytics can improve their operational efficiency by up to 25%. This growing emphasis on data-driven strategies is likely to propel the adoption of smart office solutions, as organizations seek to harness the power of data to drive innovation and growth within the Smart Office Market.