Growing Demand for Energy Efficiency

The Smart Indoor Lighting Market is significantly influenced by the growing demand for energy-efficient solutions. As energy costs continue to rise, consumers and businesses alike are seeking ways to reduce their energy consumption. Smart lighting systems, which often utilize LED technology, are known for their lower energy usage compared to traditional lighting solutions. Reports indicate that smart lighting can reduce energy consumption by up to 75%, making it an attractive option for environmentally conscious consumers. Additionally, government initiatives promoting energy efficiency and sustainability are further propelling the adoption of smart lighting solutions. This trend is expected to continue, as more individuals and organizations recognize the long-term cost savings associated with energy-efficient lighting.

Increased Awareness of Smart Home Benefits

The Smart Indoor Lighting Market is benefiting from an increased awareness of the advantages associated with smart home technologies. As consumers become more informed about the convenience, security, and energy savings offered by smart lighting systems, the demand for these products is likely to rise. Surveys indicate that a significant percentage of homeowners are considering the integration of smart lighting into their homes, with many citing enhanced control and automation as key benefits. This growing interest is further supported by the proliferation of smart home devices, which often work in tandem with smart lighting solutions. As the market evolves, manufacturers are expected to introduce more user-friendly and affordable options, making smart lighting accessible to a broader audience.

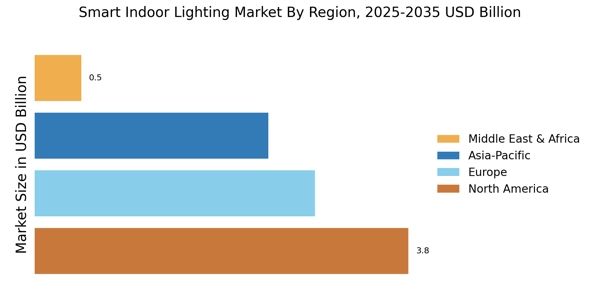

Rising Urbanization and Smart City Initiatives

The Smart Indoor Lighting Market is also being driven by rising urbanization and the implementation of smart city initiatives. As urban areas expand, there is an increasing need for efficient and sustainable lighting solutions that can accommodate growing populations. Smart lighting systems are being integrated into urban infrastructure to enhance public safety, reduce energy consumption, and improve the overall quality of life for residents. Many cities are investing in smart lighting as part of their broader smart city strategies, which aim to leverage technology to create more livable and sustainable urban environments. This trend is expected to accelerate, as municipalities recognize the potential benefits of smart lighting in addressing urban challenges.

Consumer Preference for Aesthetics and Ambiance

The Smart Indoor Lighting Market is influenced by consumer preferences for aesthetics and ambiance in living spaces. As individuals seek to create personalized environments, smart lighting solutions that offer customizable color temperatures and brightness levels are becoming increasingly popular. The ability to adjust lighting to suit different moods or activities enhances the overall living experience. Market data suggests that a significant portion of consumers prioritize aesthetics when selecting lighting solutions, indicating a shift towards products that not only serve functional purposes but also contribute to interior design. This trend is likely to continue, as manufacturers innovate to provide more versatile and visually appealing smart lighting options.

Technological Advancements in Lighting Solutions

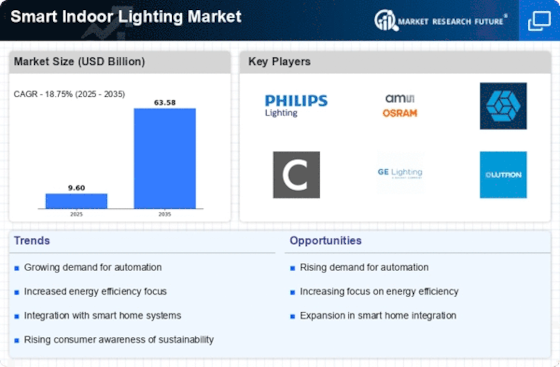

The Smart Indoor Lighting Market is experiencing a surge in technological advancements, particularly with the integration of LED technology and IoT capabilities. These innovations allow for enhanced control and automation of lighting systems, which can be managed remotely via smartphones or voice-activated devices. As of 2025, the market is projected to grow at a compound annual growth rate of approximately 20%, driven by the increasing adoption of smart home technologies. The ability to customize lighting settings not only improves user experience but also contributes to energy savings, making these systems more appealing to consumers. Furthermore, advancements in sensor technology enable smart lighting to adapt to environmental changes, thereby optimizing energy consumption and enhancing overall efficiency.