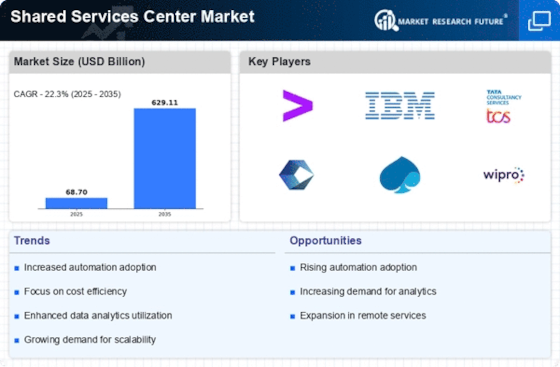

The Shared Services Center Market will continue to grow due to major companies in the industry making significant R&D investments to extend their product ranges. Significant market developments include new product releases, contractual agreements, mergers and acquisitions, greater investments, and cooperation with other organizations. Market participants also engage in various strategic actions to broaden their global footprint. The Shared Services Center Market sector must provide affordable products & services to grow and thrive in a more cutthroat and dynamic market.One of the main strategies manufacturers use in the worldwide Shared Services Center Market is local manufacturing, which expands the market sector and helps customers by lowering operating costs. Some of the biggest medical benefits in recent years have come from the Shared Services Center Market sector. Major players in the Shared Services Center Market, including Accenture plc, Genpact Ltd., Deloitte Touche Tohmatsu Limited, Tata Consultancy Services Limited, WNS (Holdings) Ltd., CGI, Inc, Capgemini SE, Infosys Limited, EXLService Holdings, Inc., International Business Machines Corporation, and others, are engaging in research and development activities in an effort to boost market demand.Information technology (IT) services are offered by Tata Consultancy Services Ltd (TCS), a subsidiary of Tata Sons Pvt Ltd. Cloud services, quality engineering, blockchain, enterprise solutions, IoT, business intelligence, business process outsourcing, and consultancy services are all provided by the company in addition to IT infrastructure services. Additionally, it provides business solutions to a range of industries, such as retail, manufacturing, information services, banking, financial services, banking media, technology, insurance, healthcare, life sciences, and education.TCS Optumera, TCS OmniStore, TCS ADD, TCS HOBS, Quartz, Jile, TCS MasterCraft, TCS BaNCS, Ignio, TAP, TCS iON, and TCS TwinX are among its software offerings. The global IT outsourcing company Tata Consultancy Services, with its headquarters in India, announced on January 17, 2023, the release of TCS Finance and the Shared Services Transformation suite, which will enable companies everywhere to leverage shared services and boost productivity.Accenture Plc offers services and solutions in the areas of strategy, consulting, digital, technology, and operations. The business manages business operations for enterprise functions, including supply chain, marketing, sales, finance and accounting, and sourcing and procurement. In addition, it provides services unique to the industry, such as banking, insurance, health services, and platform trust and safety. The corporation provides services to the following industries: communications, media and technology, agribusiness, automotive, finance, capital markets, retail, travel, health, and chemicals. Accenture plc. It acquired Nautilus Consulting in September 2023.As a result of the growing effects of healthcare digitization, Nautilus Consulting specializes in electronic patient record solutions. This is similar to the shared services center trend in the industry, wherein industries such as healthcare concentrate on supporting operations to increase productivity. Accenture's move highlights the need for digital healthcare expertise and propels market expansion to address industry-specific requirements.