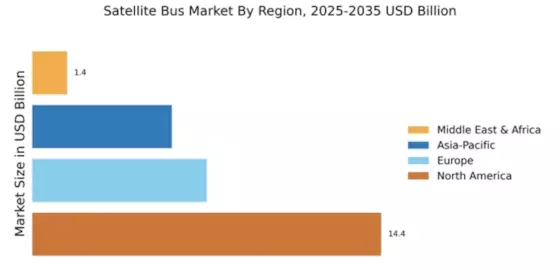

Market Growth Projections

The Global Satellite Bus Market Industry is poised for substantial growth, with projections indicating a market value of 12.4 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate of 5.27% from 2025 to 2035. The increasing demand for satellite services across various sectors, including telecommunications, defense, and environmental monitoring, is expected to drive this expansion. As technology continues to advance and new applications for satellite buses emerge, the market is likely to witness a diversification of offerings, catering to a broader range of customer needs and preferences.

Emerging Commercial Space Sector

The emergence of the commercial space sector is reshaping the Global Satellite Bus Market Industry. Private companies are increasingly entering the satellite manufacturing and launch markets, driven by advancements in technology and decreasing launch costs. This influx of private investment is fostering innovation and competition, leading to the development of new satellite bus designs and services. Companies like SpaceX and OneWeb are pioneering satellite constellations that aim to provide global internet coverage, which could significantly alter the landscape of satellite communications. As the commercial sector continues to grow, it is likely to create new opportunities and challenges for traditional satellite bus manufacturers.

Advancements in Satellite Technology

Technological advancements play a pivotal role in shaping the Global Satellite Bus Market Industry. Innovations such as miniaturization, improved propulsion systems, and enhanced payload capabilities are transforming satellite design and functionality. These advancements not only reduce costs but also increase the operational efficiency of satellites. For instance, the development of small satellite buses enables the deployment of constellations that enhance global coverage and data collection capabilities. As technology continues to evolve, it is likely that the market will see a diversification of satellite applications, further driving growth and expanding the scope of satellite missions.

Government Investments in Space Programs

Government investments in space programs significantly influence the Global Satellite Bus Market Industry. Countries worldwide are recognizing the strategic importance of space capabilities, leading to increased funding for satellite development and launch initiatives. For example, nations such as the United States, China, and India are actively expanding their satellite fleets to enhance national security, scientific research, and commercial opportunities. This trend is likely to bolster the market, as government contracts often provide a stable revenue stream for satellite bus manufacturers. The emphasis on international collaboration in space exploration may also create new opportunities for growth in the industry.

Increasing Demand for Communication Satellites

The Global Satellite Bus Market Industry experiences a surge in demand for communication satellites, driven by the growing need for reliable communication infrastructure across various sectors. As of 2024, the market is valued at approximately 7.04 USD Billion, reflecting the increasing reliance on satellite technology for telecommunications, broadcasting, and internet services. The proliferation of mobile devices and the expansion of internet connectivity in remote areas further fuel this demand. This trend is expected to continue, with projections indicating a market growth to 12.4 USD Billion by 2035, suggesting a robust CAGR of 5.27% from 2025 to 2035.

Growing Demand for Earth Observation Satellites

The Global Satellite Bus Market Industry is witnessing a growing demand for Earth observation satellites, driven by the need for environmental monitoring, disaster management, and agricultural planning. These satellites provide critical data that supports decision-making in various sectors, including climate science, urban planning, and resource management. The increasing awareness of climate change and the need for sustainable practices further amplify this demand. As the market evolves, it is expected that the integration of advanced sensors and imaging technologies will enhance the capabilities of Earth observation satellites, thereby expanding their applications and driving market growth.