Market Trends

Key Emerging Trends in the Rowing Machines Market

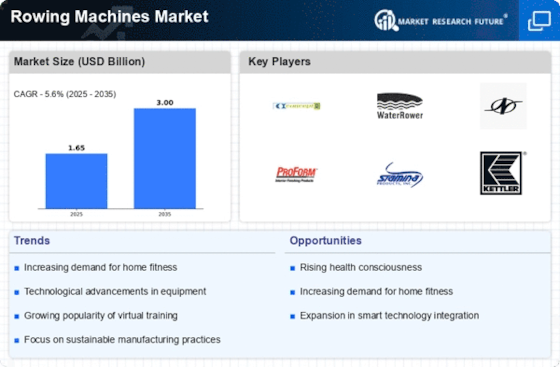

Notable changes in the rowing machine market are a reflection of changing customer tastes, technology developments, and the dynamics of the fitness sector. The COVID-19 epidemic and changes in lifestyle have led to a notable trend of increased attention being paid to home fitness solutions. Customers are looking for adaptable and efficient home exercise equipment, and rowing machines have become more popular because of its advantages for a full-body, low-impact workout. The ease of working out from home has increased demand for small, space-saving rowing machines that provide a powerful cardiovascular exercise for people who want to continue their fitness regimens at home. The landscape of rowing machines is changing as a result of technological innovation and developments. Fitness equipment that is smart and linked has becoming more popular. It incorporates features like performance tracking, interactive training plans, and live streaming of workouts. These technology advances are being integrated by manufacturers into rowing machines to give consumers individualized and immersive exercise experiences. Complying with the trend towards linked fitness solutions, rowing machines have become even more appealing due to their integration with fitness applications and virtual coaching services. In addition, the market for rowing machines has been influenced by the growth of specialized fitness facilities and group exercise programs. Rowing workouts are inclusive and beneficial for people of all fitness levels, which is why rowing-based fitness courses and studios have become more and more popular. The demand for rowing machines with features like real-time performance analytics and adjustable resistance levels that replicate the sensation of group exercise has increased as a result of this trend. Rowing machines have been introduced to the market to precisely serve this specific client base that is looking for immersive without sessions. The focus on ergonomic design and user comfort is another trend that is influencing the rowing machine industry. Producing rowing machines with ergonomic chairs, movable footrests, and silent, quiet operation, manufacturers are putting a premium on comfort during workouts. Improved comfort and usability make working out more pleasurable and draw in a wider range of customers looking for exercise equipment that is easy to use. Sustainability and environmental awareness are driving market trends in the fitness sector, and rowing machines are no exception. The market for eco-friendly production techniques and materials in exercise equipment is expanding. In response, companies are creating rowing machines using sustainable materials and production techniques to appeal to customers looking for green exercise choices. Additionally, there is a trend in the market for multipurpose rowing machines that provide a variety of training alternatives in addition to rowing. Certain machines include extra attachments or features that let users use them for other types of exercises, such resistance training or strength training. This trend is in line with customer demands for exercise equipment that is multipurpose, compact, and offers an all-encompassing workout. The accessibility and cost-effectiveness of entry-level rowing machines have also influenced consumer preferences. With more affordable choices available, the market has grown and more people with different fitness objectives and financial restraints may now use rowing machines in their workout regimens. The market trends for rowing machines are influenced by factors such as the increasing need for at-home workout solutions, connected fitness technology advancements, boutique fitness experiences, ergonomic design considerations, sustainability preferences, multifunctionality, and affordability. The market for rowing machines is anticipated to see more advancements as consumer tastes and technology develop, meeting the varied fitness goals and preferences of customers looking for convenient, efficient, and interesting training options.

Leave a Comment