Rowing Machines Size

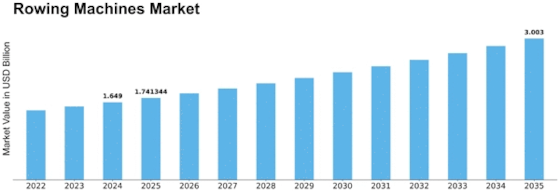

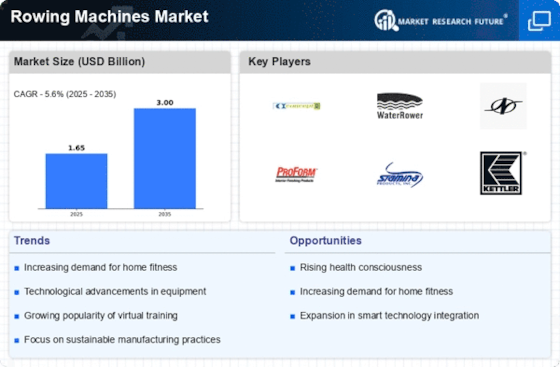

Rowing Machines Market Growth Projections and Opportunities

Numerous market aspects impacting the rowing machines market together contribute to its dynamics, trends, and overall growth. Growing customer knowledge of the value of health and fitness is one important reason. People are prioritizing their health more and more, which is driving up demand for functional and adaptable home exercise equipment. Rowing machines are becoming more and more popular since they offer a full-body workout. One of the main factors boosting the market's demand for rowing machines is the growing awareness of health issues. Developments in technology have a significant impact on market dynamics in the rowing machine sector. The user experience is improved overall by the incorporation of intelligent features including real-time performance tracking, interactive training programs, and connectivity to fitness applications. Rowing machines that provide a digitally enhanced exercise regimen that increases motivation and engagement are attracting more and more customers. This technological integration gives producers a competitive edge, which helps to develop the market overall while also catering to the changing demands of customers. The COVID-19 epidemic has contributed to a global trend towards home-based workout solutions, which in turn has had a huge impact on the rowing machine industry. Rowing machines have become a popular option for low-impact yet effective cardiovascular training as more people choose for quick and easy at-home exercises. It is anticipated that this trend will continue, highlighting the market's relevance for home fitness equipment and influencing rowing machine design and functionality to meet the needs of at-home workout regimens. User-friendly design and ergonomics are two more important market factors. Customers want for rowing machines that are easy to use, adjustable, and comfortable. In response, manufacturers are improving the whole user experience by adding adjustable resistance levels, cozy chairs, and ergonomic designs. The emphasis on features that are easy to use responds to the market's requirement for rowing machines that can accommodate a wide range of customer preferences and demands.

Leave a Comment