E-Commerce Growth

The rise of e-commerce is transforming the retail landscape, significantly influencing the Roasted Snacks Market. As consumers increasingly turn to online shopping for convenience, the demand for roasted snacks through digital platforms is surging. Recent statistics reveal that online snack sales have grown by over 25% in the past year, reflecting a shift in consumer purchasing behavior. This trend is prompting brands to enhance their online presence and invest in digital marketing strategies to reach a broader audience. Additionally, the availability of subscription services for snacks is gaining popularity, providing consumers with a hassle-free way to enjoy their favorite roasted snacks regularly. As e-commerce continues to expand, the Roasted Snacks Market is poised for substantial growth, driven by the increasing preference for online shopping.

Diverse Flavor Profiles

The Roasted Snacks Market is experiencing a notable expansion in flavor diversity, catering to the evolving palates of consumers. As globalization continues to influence food preferences, there is a growing appetite for unique and exotic flavors in roasted snacks. This trend is not merely a passing phase; it appears to be a fundamental shift in consumer behavior. Data suggests that snacks with bold flavors, such as spicy, savory, and sweet combinations, are gaining traction, with sales in this category increasing by over 15% in the past year. This diversification allows brands to differentiate themselves in a competitive market, appealing to a broader audience. As a result, the Roasted Snacks Market is likely to see an influx of innovative flavor offerings, which could further enhance consumer engagement and brand loyalty.

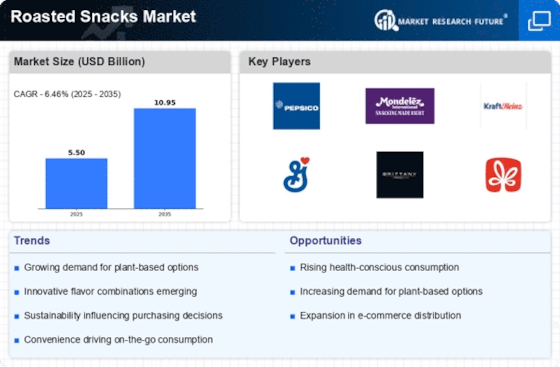

Health and Wellness Trends

The increasing consumer focus on health and wellness is a pivotal driver for the Roasted Snacks Market. As individuals become more health-conscious, they seek snacks that offer nutritional benefits without compromising on taste. This trend has led to a surge in demand for roasted snacks that are low in calories, high in protein, and rich in essential nutrients. According to recent data, the health-oriented snack segment is projected to grow at a compound annual growth rate of approximately 8% over the next five years. This shift in consumer preferences is prompting manufacturers to innovate and reformulate their products, ensuring they align with the evolving dietary needs of consumers. Consequently, the Roasted Snacks Market is witnessing a transformation, with brands increasingly emphasizing clean labels and natural ingredients.

Sustainability Initiatives

Sustainability is becoming an increasingly critical factor influencing the Roasted Snacks Market. Consumers are more aware of environmental issues and are actively seeking products that align with their values. This has prompted manufacturers to adopt sustainable practices, such as sourcing ingredients responsibly and utilizing eco-friendly packaging. Recent studies indicate that products marketed as sustainable can command a premium price, with consumers willing to pay up to 20% more for snacks that are environmentally friendly. This trend not only benefits the planet but also enhances brand reputation and consumer trust. As sustainability continues to shape purchasing decisions, the Roasted Snacks Market is likely to see a rise in brands that prioritize ethical sourcing and environmentally conscious production methods.

Convenience and On-the-Go Consumption

The fast-paced lifestyle of modern consumers is driving the demand for convenient snack options, significantly impacting the Roasted Snacks Market. As individuals seek quick and easy snack solutions, roasted snacks are increasingly favored for their portability and ease of consumption. Data indicates that single-serve packaging is becoming more prevalent, with sales of on-the-go snack packs rising by approximately 12% in the last year. This trend is particularly appealing to busy professionals and health-conscious individuals who prefer nutritious snacks that can be consumed anywhere. Consequently, manufacturers are focusing on creating convenient packaging solutions that cater to this demand, thereby enhancing the overall consumer experience. The Roasted Snacks Market is likely to continue evolving in response to these convenience-driven preferences.