Top Industry Leaders in the roasted snack Market

The competitive landscape of the roasted snacks market is dynamic and evolving, driven by shifting consumer preferences towards healthier snack options. Key players in this market employ various strategies to maintain and expand their market share. As of my last knowledge update in January 2022, I don't have access to real-time data or specific developments in 2023. However, I can provide a comprehensive overview of the competitive scenario as of my last update.

Strategies Adopted:

Companies in the roasted snacks market deploy various strategies to stay competitive. Product innovation is a common approach, with an emphasis on introducing unique flavors and healthier alternatives. Marketing and branding play a crucial role, with an emphasis on communicating the nutritional benefits of roasted snacks. Strategic partnerships, mergers, and acquisitions are also prevalent strategies to expand market reach and enhance product portfolios.

Factors for Market Share Analysis:

Market share analysis in the roasted snacks industry considers factors such as brand recognition, product innovation, distribution channels, and consumer loyalty. The ability to adapt to changing consumer preferences and dietary trends, as well as the effectiveness of marketing campaigns, plays a pivotal role. Key performance indicators also include revenue growth, market penetration, and the ability to establish a strong presence in emerging markets.

New and Emerging Companies:

As consumer demand for healthier snacks rises, new and emerging companies are entering the roasted snacks market. These companies often focus on niche segments, introducing innovative ingredients and flavors. While their market share may be modest compared to industry giants, their agility and capacity for rapid adaptation contribute to the overall competitiveness of the sector.

Industry News and Current Company Investment Trends:

In the roasted snacks market, industry news often revolves around product launches, partnerships, and sustainability initiatives. Companies are increasingly investing in research and development to create snacks that cater to specific dietary needs, such as gluten-free or vegan options. Sustainable sourcing of ingredients and eco-friendly packaging are becoming significant trends, reflecting a broader consumer shift toward ethical and environmentally conscious choices.

Overall Competitive Scenario:

The roasted snacks market is characterized by intense competition, with established players defending their positions against new entrants and smaller, innovative companies. The focus on health and wellness, coupled with the demand for convenient, on-the-go snacks, continues to drive market growth. Companies that successfully balance taste, nutritional value, and sustainability are likely to thrive in this competitive landscape.

Recent Developments in 2023:

While specific developments in 2023 are not available to me, anticipated trends may include increased emphasis on plant-based and protein-rich roasted snacks, further innovation in flavor profiles, and a growing focus on sustainability and ethical sourcing. Companies are likely to continue investing in digital marketing strategies and e-commerce platforms to reach a broader consumer base.

In conclusion, the competitive landscape of the roasted snacks market is shaped by the dynamic interplay of innovation, marketing, and consumer trends. Key players will need to stay attuned to evolving preferences and invest in strategies that align with the growing demand for healthier, flavorful snack options.

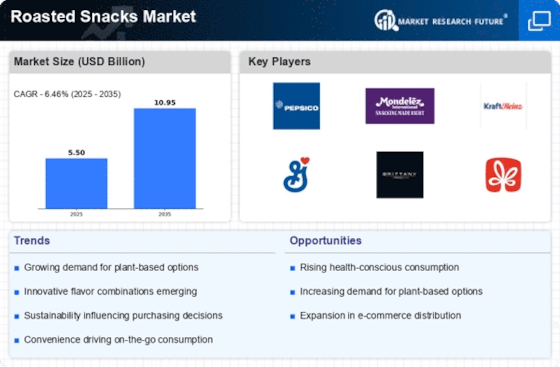

Key Companies in the Roasted Snacks market include.

Biena Snacks (US)

ITC Limited (India)

Jayone Foods Inc. (US)

SunOpta Inc. (Canada)

Godrej (India)

PepsiCo (US)

General Mills Inc. (US)

Nestlé S.A. (Switzerland)

Thanasi Foods LLC (US)

Mondelēz International Inc. (US)

B&G Foods Inc. (US)

The Kellogg Company (US)

B&G Foods Inc. (US)

Diamond Foods LLC (US)

Conagra Brands (US)

The American Pop Corn Company (US)