Growing Applications in Diagnostics

The RNA Analysis Market is expanding due to the increasing applications of RNA analysis in diagnostics. RNA biomarkers are becoming essential in the early detection and monitoring of various diseases, including cancers and infectious diseases. The integration of RNA analysis into diagnostic workflows is enhancing the accuracy and speed of disease identification, which is crucial for effective treatment. The global market for molecular diagnostics, which includes RNA analysis, is projected to exceed 20 billion USD by 2025. This growth indicates a strong demand for RNA analysis technologies and services, as healthcare providers seek to implement more effective diagnostic tools. Consequently, the RNA Analysis Market is likely to benefit from this trend, as it aligns with the broader movement towards precision medicine.

Rising Investment in Genomic Research

The RNA Analysis Market is benefiting from a significant increase in investment directed towards genomic research. Governments and private entities are recognizing the importance of RNA research in understanding genetic diseases and developing new therapies. Funding initiatives aimed at advancing RNA research are becoming more prevalent, which is likely to stimulate innovation and growth within the RNA Analysis Market. For instance, funding for genomic research has seen a substantial rise, with billions allocated annually to support various projects. This influx of capital is expected to enhance research capabilities and drive the development of new RNA analysis technologies, thereby expanding the market's potential.

Increased Focus on Personalized Medicine

The RNA Analysis Market is witnessing a heightened emphasis on personalized medicine, which tailors treatment strategies based on individual genetic profiles. This trend is largely driven by the growing recognition of the role of RNA in disease mechanisms and treatment responses. As healthcare systems increasingly adopt personalized approaches, the demand for RNA analysis tools and services is expected to rise. The market for personalized medicine is anticipated to grow at a compound annual growth rate (CAGR) of over 10% in the coming years, reflecting the potential of RNA analysis in developing targeted therapies. This shift towards personalized medicine is likely to propel the RNA Analysis Market forward, as researchers and clinicians seek to leverage RNA data for improved patient outcomes.

Technological Advancements in RNA Analysis

The RNA Analysis Market is experiencing a surge in technological advancements that enhance the precision and efficiency of RNA analysis. Innovations such as next-generation sequencing (NGS) and CRISPR technology are revolutionizing the field, allowing for more detailed and accurate analysis of RNA molecules. These advancements are not only improving research capabilities but also facilitating the development of novel therapeutics. The market for RNA sequencing is projected to reach approximately 10 billion USD by 2026, indicating a robust growth trajectory. As these technologies become more accessible, they are likely to drive further investment and interest in the RNA Analysis Market, fostering a competitive landscape that encourages continuous innovation.

Emerging Markets and Increased Accessibility

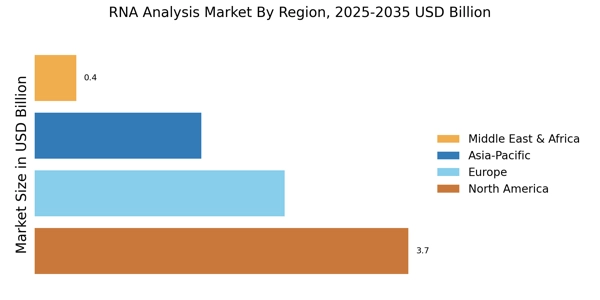

The RNA Analysis Market is poised for growth as emerging markets begin to adopt RNA analysis technologies. As healthcare infrastructure improves in these regions, access to advanced RNA analysis tools is becoming more feasible. This trend is likely to open new avenues for market expansion, as researchers and healthcare providers in these areas seek to leverage RNA analysis for various applications, including research and diagnostics. The increasing availability of cost-effective RNA analysis solutions is also contributing to this trend, making it easier for institutions in emerging markets to integrate these technologies into their workflows. As a result, the RNA Analysis Market may experience a significant boost from these developments, reflecting a broader trend towards global health equity.