Collaborative Research Initiatives

The NGS-based RNA-sequencing Market is benefiting from collaborative research initiatives among academic institutions, healthcare organizations, and biotechnology companies. These partnerships facilitate the sharing of resources, expertise, and data, accelerating the pace of research and development in RNA sequencing technologies. Notably, large-scale projects, such as the Human Genome Project, have laid the groundwork for collaborative efforts in RNA sequencing. Such initiatives not only enhance the quality of research but also drive innovation in sequencing methodologies. As collaboration continues to grow, the market is expected to see increased funding and support, further propelling the adoption of NGS-based RNA sequencing solutions.

Rising Demand for Biomarker Discovery

The NGS-based RNA-sequencing Market is significantly influenced by the rising demand for biomarker discovery. Biomarkers are essential for early disease detection, prognosis, and treatment monitoring, particularly in cancer and genetic disorders. RNA sequencing provides comprehensive insights into gene expression profiles, enabling researchers to identify novel biomarkers with high specificity and sensitivity. The market for biomarker discovery is projected to grow at a CAGR of 15% over the next few years, driven by the increasing need for precision medicine. As pharmaceutical companies and research institutions invest in NGS technologies for biomarker identification, the NGS-based RNA sequencing market is likely to expand in tandem.

Increased Focus on Personalized Medicine

The NGS-based RNA-sequencing Market is being propelled by the growing emphasis on personalized medicine. As healthcare shifts towards tailored treatment approaches, RNA sequencing plays a crucial role in understanding individual genetic profiles and disease mechanisms. This trend is particularly evident in oncology, where RNA sequencing is utilized to identify specific mutations and gene expressions that inform targeted therapies. The market is expected to reach a valuation of USD 5 billion by 2026, reflecting the increasing investment in personalized healthcare solutions. Consequently, the demand for NGS-based RNA sequencing technologies is likely to surge as healthcare providers seek to implement more effective and individualized treatment plans.

Growing Applications in Clinical Diagnostics

The NGS-based RNA-sequencing Market is witnessing a surge in applications within clinical diagnostics. The ability of RNA sequencing to provide detailed insights into gene expression and transcriptomic profiles is transforming diagnostic practices. Healthcare providers are increasingly utilizing NGS technologies for the diagnosis of various diseases, including infectious diseases, genetic disorders, and cancers. The market for clinical diagnostics is anticipated to grow significantly, with RNA sequencing becoming a standard tool in diagnostic laboratories. This trend is likely to be supported by regulatory approvals and the establishment of clinical guidelines advocating the use of NGS-based RNA sequencing in routine diagnostics, thereby expanding the market further.

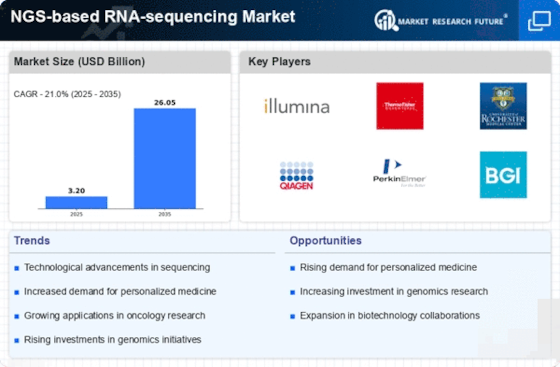

Technological Advancements in Sequencing Technologies

The NGS-based RNA-sequencing Market is experiencing rapid growth due to continuous technological advancements. Innovations in sequencing technologies, such as improvements in accuracy, speed, and cost-effectiveness, are driving market expansion. For instance, the introduction of third-generation sequencing platforms has significantly reduced the time required for RNA sequencing, making it more accessible for research and clinical applications. Furthermore, the integration of artificial intelligence and machine learning in data analysis is enhancing the interpretation of complex RNA sequencing data. As a result, the market is projected to witness a compound annual growth rate (CAGR) of approximately 20% over the next five years, indicating a robust demand for advanced sequencing solutions.