Market Growth Projections

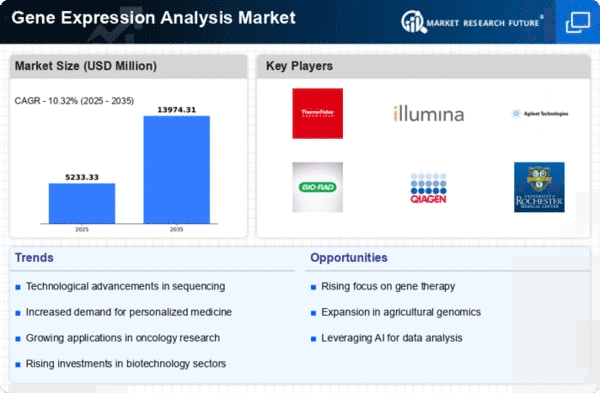

The Global Gene Expression Analysis Market Industry is projected to experience substantial growth, with estimates indicating a rise from 4.74 USD Billion in 2024 to 14.0 USD Billion by 2035. This growth trajectory reflects a compound annual growth rate (CAGR) of 10.33% from 2025 to 2035. Such projections highlight the increasing importance of gene expression analysis in various sectors, including healthcare, pharmaceuticals, and biotechnology. As advancements in technology and research continue to unfold, the market is likely to attract further investments, fostering innovation and expanding its applications across diverse fields.

Growing Prevalence of Chronic Diseases

The rising prevalence of chronic diseases globally significantly influences the Global Gene Expression Analysis Market Industry. Chronic conditions such as cancer, diabetes, and cardiovascular diseases necessitate a deeper understanding of the underlying genetic factors contributing to these ailments. Gene expression analysis provides critical insights into disease mechanisms, enabling the development of targeted therapies. As healthcare systems increasingly prioritize precision medicine to combat these diseases, the demand for gene expression analysis is expected to rise. This trend aligns with the overall market growth trajectory, as stakeholders seek effective solutions to address the global health burden.

Increased Funding for Genomic Research

The Global Gene Expression Analysis Market Industry benefits from increased funding directed towards genomic research initiatives. Governments and private organizations are recognizing the importance of genomics in advancing healthcare solutions. For instance, substantial investments in research grants and public-private partnerships are fostering innovation in gene expression analysis. This influx of funding supports the development of new technologies and methodologies, which in turn enhances the capabilities of researchers. As a result, the market is poised for growth, with funding initiatives likely to drive further exploration into the complexities of gene expression and its implications for health.

Emerging Applications in Drug Discovery

Emerging applications of gene expression analysis in drug discovery are reshaping the Global Gene Expression Analysis Market Industry. Pharmaceutical companies are increasingly leveraging gene expression data to identify potential drug targets and biomarkers, streamlining the drug development process. By understanding how genes are expressed in various disease states, researchers can develop more effective and tailored therapies. This trend is likely to contribute to the market's expansion, as the pharmaceutical industry recognizes the value of integrating gene expression analysis into their research pipelines, thereby enhancing the efficiency and success rates of drug discovery efforts.

Rising Demand for Personalized Medicine

The Global Gene Expression Analysis Market Industry experiences a notable surge in demand for personalized medicine, driven by advancements in genomics and biotechnology. As healthcare shifts towards individualized treatment plans, gene expression analysis plays a critical role in understanding patient-specific responses to therapies. This trend is underscored by the projected market growth from 4.74 USD Billion in 2024 to 14.0 USD Billion by 2035, reflecting a compound annual growth rate (CAGR) of 10.33% from 2025 to 2035. The integration of gene expression data into clinical practice enhances the efficacy of treatments, thereby fostering further investment in this sector.

Technological Advancements in Analytical Tools

Technological innovations significantly propel the Global Gene Expression Analysis Market Industry, as new analytical tools enhance the precision and efficiency of gene expression studies. The advent of high-throughput sequencing technologies and advanced bioinformatics platforms allows researchers to analyze vast amounts of genetic data rapidly. These advancements not only improve the accuracy of results but also reduce the time required for analysis. Consequently, the market is likely to expand as researchers and healthcare professionals increasingly adopt these sophisticated tools, thereby facilitating breakthroughs in disease understanding and treatment development.