Top Industry Leaders in the Reverse Vending Machine Market

*Disclaimer: List of key companies in no particular order

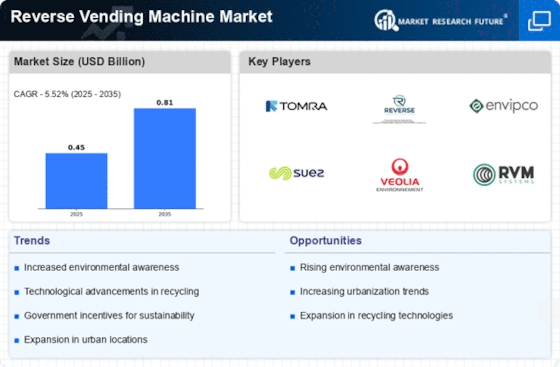

Top listed global companies in the Reverse Vending Machine industry are:

TOMRA System ASA

ACO Recycling

ENVIPCO

Veolia

RVM Systems.

Endlos

Sielaff GmbH

AKE Environmental

Incom Recycle Co.,Ltd

Kansmacker Mfg

Bridging the Gap by Exploring the Competitive Landscape of the Reverse Vending Machine Top Players

The reverse vending machine (RVM) market is experiencing a surge in momentum, driven by escalating environmental concerns, supportive government policies, and rising consumer consciousness. Within this dynamic landscape, a diverse range of players is vying for market share, employing distinct strategies and capitalizing on emerging trends.

Key Players and their Strategies:

- Established Giants: Industry leaders like Tomra and Envipco leverage their extensive experience and robust infrastructure to secure large-scale contracts with governments and waste management companies. They prioritize technological innovation, focusing on efficient sorting mechanisms, smart data collection, and user-friendly interfaces.

- Regional Champions: Companies like RVM Systems AS in Europe and Kansmacker in North America cater to specific regional needs and regulations. They excel in customization and adaptability, offering RVMs tailored to local container deposit schemes and waste streams.

- Technology Disruptors: Emerging players like RePlanet Robotics and I'm Green – Plastic Bank introduce cutting-edge solutions like AI-powered material recognition and gamified recycling experiences. They aim to bridge the gap between user convenience and environmental impact.

Factors for Market Share Analysis:

- Geographical Presence: The presence of mandatory container deposit legislation (CDL) plays a crucial role, with regions like Europe and North America driving demand. Players with strong footprints in these regions hold an advantage.

- Technology Portfolio: Advanced features like multi-material acceptance, high-speed sorting, and real-time data analytics attract attention from municipalities and waste management companies. Strong R&D capabilities and a diverse product portfolio are key differentiators.

- Business Model Diversification: Offering comprehensive service packages that include installation, maintenance, and data management allows players to lock in long-term contracts and establish recurring revenue streams.

- Partnerships and Collaborations: Strategic partnerships with government agencies, waste management companies, and consumer brands enhance brand visibility, expand reach, and create win-win scenarios for all stakeholders.

Emerging Trends and Innovations:

- Internet of Things (IoT) Integration: Connecting RVMs to IoT networks enables real-time data collection and analysis, optimizing collection routes, predicting container volumes, and improving operational efficiency.

- Material Recognition and Smart Sorting: AI-powered systems capable of accurately identifying and sorting various materials (including non-traditional recyclables) are revolutionizing waste management and enhancing recycling rates.

- Gamification and Reward Systems: Gamifying the recycling process through points, rewards, and leaderboards incentivizes user participation and promotes responsible waste disposal.

- Focus on Circular Economy: Integrating RVMs with closed-loop recycling systems where collected materials are directly fed back into production processes contributes to a more sustainable future.

Overall Competitive Scenario:

The RVM market is characterized by intense competition, with established players facing pressure from regional champions and technology disruptors. Success hinges on continuous innovation, strategic partnerships, and a deep understanding of evolving customer needs and regulatory landscapes. Companies that proactively embrace new technologies, prioritize sustainability, and offer holistic solutions are poised to capture a larger share of this burgeoning market.

As the RVM market continues to evolve, collaboration and knowledge sharing between stakeholders, including manufacturers, operators, policymakers, and consumers, will be crucial to optimize recycling infrastructure, maximize resource recovery, and build a circular economy for the future.

This analysis provides a snapshot of the current competitive landscape in the RVM market. However, it is important to note that the dynamics are constantly changing, and staying abreast of the latest trends and developments is essential for players to secure long-term success in this exciting and impactful space.

Latest Company Updates:

TOMRA System ASA:

- October 26, 2023: Announced partnership with Coca-Cola Europacific Partners for RVM deployment in Australia. (Source: TOMRA press release)

ENVIPCO:

- December 05, 2023: Received an order for 500 RVM units from a major retailer in the US. (Source: ENVIPCO press release)

Veolia:

- October 20, 2023: Partnered with TOMRA for RVM deployment in France. (Source: Veolia website)

RVM Systems:

- November 01, 2023: Unveiled the RVM Xpress, a compact and high-speed RVM suitable for small spaces. (Source: RVM Systems website)