Regulatory Support

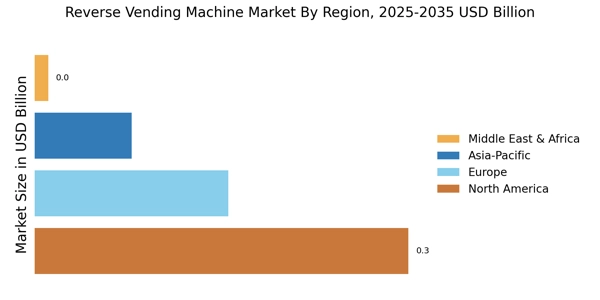

Regulatory frameworks and government support are increasingly influencing the Reverse Vending Machine Market. Many governments are implementing policies that mandate recycling and waste reduction, thereby creating a favorable environment for the adoption of reverse vending machines. Incentives such as subsidies and grants for businesses that invest in recycling technologies further stimulate market growth. Recent statistics indicate that regions with stringent recycling regulations have seen a notable increase in the installation of reverse vending machines, suggesting a direct correlation between regulatory support and market expansion. This trend is likely to continue as more jurisdictions recognize the importance of sustainable waste management.

Consumer Behavior Shifts

Shifts in consumer behavior towards sustainability and environmental responsibility are significantly impacting the Reverse Vending Machine Market. As consumers become more conscious of their ecological footprint, they are increasingly seeking ways to participate in recycling initiatives. This change in mindset is driving demand for reverse vending machines, which offer a convenient solution for recycling. Market Research Future indicates that a substantial percentage of consumers are willing to engage with machines that provide incentives for recycling, such as cash rewards or discounts. This evolving consumer behavior is likely to propel the market forward, as businesses respond to the demand for accessible recycling options.

Technological Integration

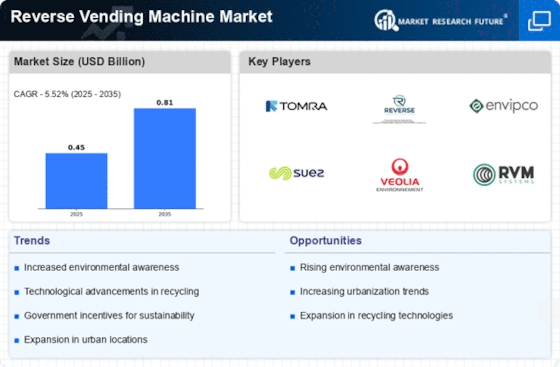

Technological advancements are playing a crucial role in shaping the Reverse Vending Machine Market. The integration of smart technologies, such as IoT and AI, enhances the functionality of these machines, allowing for real-time data collection and user engagement. This technological evolution not only improves operational efficiency but also provides valuable insights into consumer behavior and recycling patterns. As a result, manufacturers are investing in innovative designs and features that cater to the evolving needs of users. The market is expected to witness a surge in demand for technologically advanced reverse vending machines, which could potentially lead to a market valuation exceeding several billion dollars in the coming years.

Sustainability Initiatives

The growing emphasis on sustainability appears to be a primary driver for the Reverse Vending Machine Market. As environmental concerns escalate, businesses and municipalities are increasingly adopting practices that promote recycling and waste reduction. This trend is reflected in the rising number of reverse vending machines deployed in public spaces, which facilitate the collection of recyclable materials. According to recent data, the market for reverse vending machines is projected to grow at a compound annual growth rate of approximately 10% over the next five years. This growth is likely fueled by the increasing demand for eco-friendly solutions and the need for efficient waste management systems.

Partnerships and Collaborations

Strategic partnerships and collaborations among stakeholders are emerging as a vital driver for the Reverse Vending Machine Market. Companies are increasingly joining forces with municipalities, retailers, and environmental organizations to enhance the reach and effectiveness of recycling initiatives. These collaborations often lead to the deployment of reverse vending machines in high-traffic areas, maximizing their visibility and usage. Furthermore, partnerships can facilitate knowledge sharing and resource pooling, which may enhance the overall efficiency of recycling programs. As the market continues to evolve, such alliances are expected to play a crucial role in expanding the presence and impact of reverse vending machines.