Retail Edge Computing Market Summary

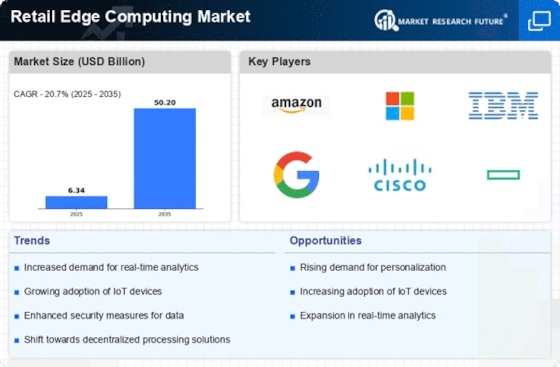

As per Market Research Future analysis, the Retail Edge Computing Market Size was estimated at 6.337 USD Billion in 2024. The Retail Edge Computing industry is projected to grow from 7.649 USD Billion in 2025 to 50.2 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 20.7% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Retail Edge Computing Market is poised for substantial growth driven by technological advancements and evolving consumer demands.

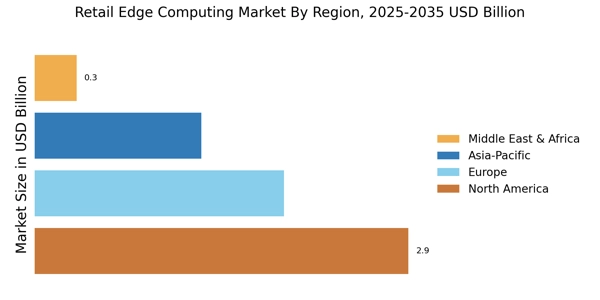

- North America remains the largest market for retail edge computing, driven by robust infrastructure and high adoption rates.

- Asia-Pacific is emerging as the fastest-growing region, fueled by rapid urbanization and increasing investments in technology.

- The hardware segment dominates the market, while the software segment is experiencing the fastest growth due to rising demand for innovative solutions.

- Key market drivers include the growing demand for real-time analytics and the rise of omnichannel retailing, which enhance customer experience.

Market Size & Forecast

| 2024 Market Size | 6.337 (USD Billion) |

| 2035 Market Size | 50.2 (USD Billion) |

| CAGR (2025 - 2035) | 20.7% |

Major Players

Amazon (US), Microsoft (US), IBM (US), Google (US), Cisco (US), Hewlett Packard Enterprise (US), Dell Technologies (US), EdgeConneX (US), Fastly (US)