Expansion of 5G Networks

The rollout of 5G networks in Germany is a pivotal driver for the retail edge-computing market. With significantly higher data transfer speeds and lower latency, 5G technology enables retailers to implement more sophisticated edge-computing solutions. This advancement allows for seamless connectivity between devices and systems, facilitating real-time data processing and analytics. As of November 2025, it is projected that 5G coverage will reach over 80% of urban areas in Germany, providing a solid foundation for the retail edge-computing market to flourish. Retailers can leverage this technology to enhance customer engagement, improve supply chain management, and optimize in-store operations, thereby creating a more efficient retail environment.

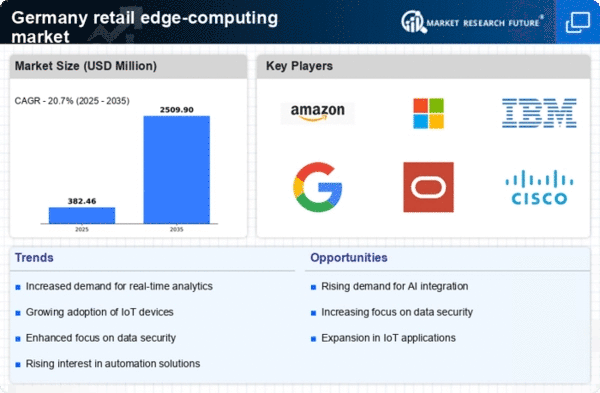

Growing Demand for Real-Time Analytics

The retail edge-computing market is experiencing a surge in demand for real-time analytics, driven by the need for immediate insights into consumer behavior and inventory management. Retailers in Germany are increasingly leveraging edge-computing solutions to process data locally, reducing latency and enhancing decision-making capabilities. According to recent studies, approximately 70% of retailers in Germany are expected to adopt edge-computing technologies by 2026, indicating a robust growth trajectory. This shift allows businesses to respond swiftly to market changes, optimize supply chains, and improve operational efficiency. As a result, the retail edge-computing market is poised for significant expansion, with investments in analytics tools and infrastructure becoming a priority for retailers aiming to stay competitive.

Integration of Artificial Intelligence

The integration of artificial intelligence (AI) into the retail edge-computing market is transforming how retailers operate in Germany. AI technologies enable advanced data processing and predictive analytics, allowing retailers to anticipate customer needs and optimize inventory levels. It is estimated that AI-driven solutions could enhance operational efficiency by up to 30% in the retail sector. This trend is particularly relevant as retailers seek to personalize customer experiences and streamline operations. The retail edge-computing market is likely to benefit from this integration, as AI applications require robust edge infrastructure to function effectively. Consequently, investments in AI and edge-computing technologies are expected to rise, further driving market growth.

Rising Focus on Operational Efficiency

The retail edge-computing market is increasingly driven by a rising focus on operational efficiency among retailers in Germany. Businesses are seeking to minimize costs and maximize productivity through the adoption of edge-computing solutions. By processing data closer to the source, retailers can reduce bandwidth costs and improve response times. Reports indicate that companies implementing edge-computing strategies have seen operational costs decrease by as much as 25%. This emphasis on efficiency is likely to propel investments in edge-computing technologies, as retailers aim to streamline processes and enhance overall performance. The retail edge-computing market is thus positioned to grow as organizations prioritize efficiency in their operations.

Increased Investment in Digital Transformation

The retail edge-computing market is benefiting from increased investment in digital transformation initiatives among German retailers. As businesses strive to modernize their operations and enhance customer experiences, edge-computing technologies are becoming integral to their strategies. It is estimated that the digital transformation market in Germany will reach €100 billion by 2026, with a significant portion allocated to edge-computing solutions. This investment trend reflects a broader recognition of the importance of technology in driving competitive advantage. Retailers are likely to adopt edge-computing solutions to support their digital transformation efforts, thereby fueling growth in the retail edge-computing market.