Expansion of 5G Infrastructure

The rollout of 5G technology in India is poised to have a profound impact on the retail edge-computing market. With its high-speed connectivity and low latency, 5G enables retailers to deploy edge-computing solutions more effectively. This technological advancement allows for seamless integration of IoT devices, enhancing the ability to collect and analyze data in real-time. As of November 2025, the Indian government has made substantial investments in 5G infrastructure, which is expected to cover over 60% of urban areas by 2026. This expansion is likely to facilitate the growth of smart retail applications, such as augmented reality and personalized shopping experiences, thereby driving demand for edge-computing solutions. Consequently, the retail edge-computing market is anticipated to benefit from the enhanced capabilities offered by 5G connectivity.

Rising Adoption of Cloud Services

The retail edge-computing market in India is witnessing a notable increase in the adoption of cloud services. Retailers are increasingly integrating edge-computing solutions with cloud platforms to enhance data storage and processing capabilities. This hybrid approach allows businesses to leverage the scalability of cloud services while benefiting from the low-latency processing offered by edge computing. As of November 2025, it is estimated that over 50% of retail businesses in India are utilizing cloud-based solutions in conjunction with edge-computing technologies. This trend is likely to continue as retailers seek to optimize their operations and improve data accessibility. The synergy between cloud and edge computing is expected to drive innovation in the retail edge-computing market, enabling more efficient data management and analysis.

Emphasis on Operational Efficiency

Operational efficiency remains a critical driver for the retail edge-computing market in India. Retailers are increasingly adopting edge-computing solutions to streamline their operations and reduce costs. By processing data closer to the source, businesses can minimize latency and enhance response times, which is essential for maintaining competitiveness in the fast-paced retail environment. Recent studies indicate that companies implementing edge-computing technologies have reported up to a 30% reduction in operational costs. This focus on efficiency is likely to propel investments in edge-computing solutions, as retailers aim to optimize their supply chains and improve inventory management. As a result, the retail edge-computing market is expected to grow as businesses prioritize technologies that enhance operational performance.

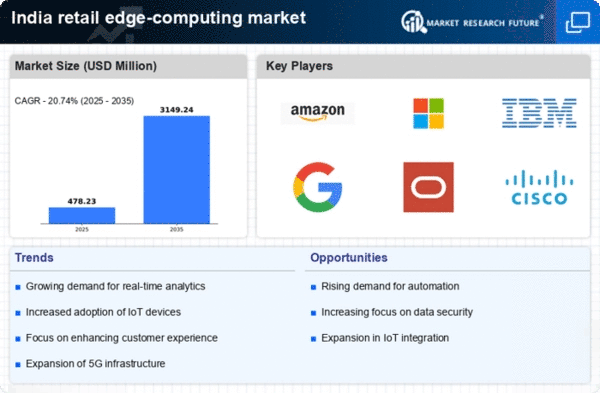

Growing Demand for Real-Time Analytics

The retail edge-computing market in India is experiencing a surge in demand for real-time analytics. Retailers are increasingly seeking to leverage data at the edge to enhance decision-making processes. This trend is driven by the need for immediate insights into customer behavior, inventory levels, and sales performance. According to recent estimates, the market for real-time analytics in retail is projected to grow at a CAGR of approximately 25% over the next five years. This growth is indicative of a broader shift towards data-driven strategies, where retailers utilize edge-computing solutions to process data locally, thereby reducing latency and improving operational efficiency. As a result, the retail edge-computing market is likely to expand significantly, as businesses invest in technologies that facilitate faster data processing and analysis.

Increased Focus on Customer Experience

In the competitive landscape of retail, enhancing customer experience has become a primary focus for businesses in India. The retail edge-computing market is responding to this trend by providing solutions that enable personalized shopping experiences. Retailers are utilizing edge-computing technologies to analyze customer data and preferences in real-time, allowing for tailored promotions and recommendations. This shift is supported by the fact that 70% of consumers are more likely to purchase from retailers that offer personalized experiences. As businesses strive to meet these expectations, investments in edge-computing solutions are likely to increase, thereby propelling the growth of the retail edge-computing market. The ability to deliver timely and relevant content to customers is becoming a key differentiator in the retail sector.