Increased Awareness and Education

There is a growing awareness regarding respiratory health, which is significantly influencing the Respiratory Disease Testing Market. Public health campaigns and educational initiatives are informing individuals about the risks associated with respiratory diseases and the importance of early diagnosis. This heightened awareness is leading to an increase in patient engagement and a proactive approach to health management. As more individuals seek testing and screening for respiratory conditions, the demand for diagnostic services is likely to rise. Healthcare providers are responding to this trend by expanding their testing capabilities, thereby contributing to the growth of the Respiratory Disease Testing Market. The emphasis on preventive care is expected to further bolster market dynamics.

Rising Prevalence of Respiratory Diseases

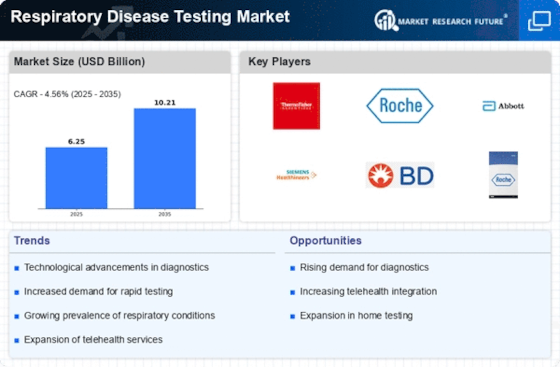

The increasing incidence of respiratory diseases, such as asthma and chronic obstructive pulmonary disease (COPD), is a primary driver of the Respiratory Disease Testing Market. According to recent estimates, respiratory diseases affect millions of individuals worldwide, leading to a heightened demand for effective diagnostic solutions. This trend is further exacerbated by environmental factors, including air pollution and smoking, which contribute to the deterioration of respiratory health. As healthcare providers seek to address this growing burden, the market for respiratory disease testing is expected to expand significantly. The need for early detection and management of these conditions is likely to propel innovations in testing methodologies, thereby enhancing the overall landscape of the Respiratory Disease Testing Market.

Technological Innovations in Testing Methods

Technological advancements in diagnostic tools are transforming the Respiratory Disease Testing Market. Innovations such as molecular diagnostics, point-of-care testing, and artificial intelligence-driven analysis are enhancing the accuracy and speed of respiratory disease detection. For instance, the integration of rapid testing methods allows for timely diagnosis, which is crucial for effective treatment. The market is witnessing a shift towards non-invasive testing techniques, which are not only more comfortable for patients but also reduce the burden on healthcare systems. As these technologies continue to evolve, they are expected to drive growth in the Respiratory Disease Testing Market, offering healthcare providers more efficient and reliable options for diagnosing respiratory conditions.

Regulatory Support for Diagnostic Innovations

Regulatory bodies are increasingly supporting innovations in the Respiratory Disease Testing Market, which is fostering an environment conducive to growth. Streamlined approval processes for new diagnostic tests and technologies are encouraging manufacturers to invest in research and development. This regulatory support is crucial for bringing novel testing solutions to market, thereby enhancing the availability of advanced diagnostic options for respiratory diseases. As regulations evolve to accommodate emerging technologies, the market is likely to experience an influx of innovative products. This trend not only benefits manufacturers but also improves patient outcomes by providing healthcare professionals with more effective tools for diagnosing respiratory conditions. The interplay between regulation and innovation is expected to shape the future of the Respiratory Disease Testing Market.

Growing Demand for Home-Based Testing Solutions

The demand for home-based testing solutions is on the rise, significantly impacting the Respiratory Disease Testing Market. As patients increasingly prefer the convenience and privacy of at-home testing, manufacturers are responding by developing user-friendly diagnostic kits. These solutions enable individuals to monitor their respiratory health without the need for frequent visits to healthcare facilities. The trend towards home testing is particularly appealing in the context of chronic respiratory conditions, where ongoing monitoring is essential. This shift not only enhances patient compliance but also alleviates pressure on healthcare systems. As the market adapts to this demand, the Respiratory Disease Testing Market is likely to witness substantial growth, driven by innovations that cater to the needs of patients seeking accessible testing options.