Rising Incidence of Cancer

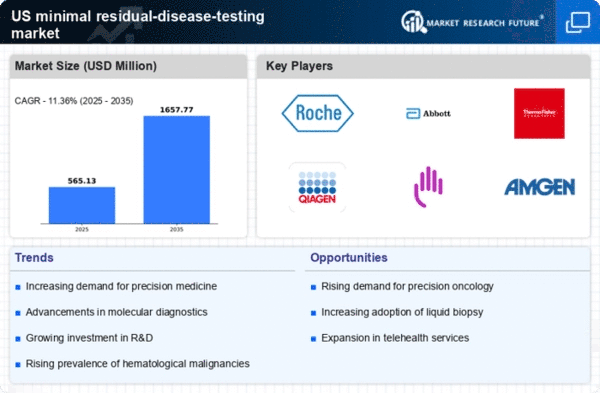

The increasing incidence of cancer in the US is a primary driver for the minimal residual-disease-testing market. According to the National Cancer Institute, approximately 1.9 million new cancer cases are expected to be diagnosed in 2025. This surge in cancer cases necessitates advanced diagnostic tools to monitor treatment efficacy and detect residual disease. As healthcare providers seek to improve patient outcomes, the demand for minimal residual disease testing is likely to rise. This market is projected to grow at a CAGR of around 12% from 2025 to 2030, reflecting the urgent need for effective monitoring solutions in oncology. The minimal residual-disease-testing market is thus positioned to expand significantly in response to these trends.

Advancements in Diagnostic Technologies

Technological innovations in diagnostic methodologies are propelling the minimal residual-disease-testing market forward. The introduction of highly sensitive techniques such as next-generation sequencing (NGS) and digital PCR has enhanced the ability to detect minimal residual disease with greater accuracy. These advancements allow for the identification of cancer cells at very low levels, which is crucial for timely intervention. The market for these technologies is expected to reach $2 billion by 2027, driven by their increasing adoption in clinical settings. As healthcare providers aim to implement cutting-edge solutions, the minimal residual-disease-testing market is likely to benefit from these technological advancements, leading to improved patient management and outcomes.

Increased Investment in Cancer Research

The minimal residual-disease-testing market is also being driven by increased investment in cancer research and development. Government funding and private sector investments are focusing on innovative diagnostic solutions that can enhance cancer treatment outcomes. The National Institutes of Health (NIH) has allocated substantial resources towards cancer research, which includes the development of advanced testing methodologies. This financial support is expected to foster innovation within the minimal residual-disease-testing market, leading to the introduction of new products and services. As research progresses, the market is likely to experience a surge in demand for effective testing solutions that can aid in the early detection of residual disease.

Regulatory Approvals and Reimbursement Policies

The evolving landscape of regulatory approvals and reimbursement policies is shaping the minimal residual-disease-testing market. Recent changes in healthcare regulations have streamlined the approval process for new diagnostic tests, making it easier for innovative solutions to enter the market. Additionally, favorable reimbursement policies are encouraging healthcare providers to adopt these tests as part of routine cancer care. As insurance coverage for minimal residual disease testing expands, patient access to these critical diagnostics is likely to improve. This trend is expected to drive market growth, with projections indicating a potential increase in market size by 15% over the next few years. The minimal residual-disease-testing market is thus poised for expansion as regulatory and reimbursement frameworks evolve.

Growing Awareness Among Healthcare Professionals

There is a notable increase in awareness among healthcare professionals regarding the importance of minimal residual disease testing in cancer management. Educational initiatives and clinical guidelines are emphasizing the role of these tests in personalizing treatment plans and improving patient prognoses. As oncologists and hematologists become more informed about the benefits of minimal residual disease testing, the demand for these services is expected to rise. This shift in professional attitudes is likely to contribute to a market growth rate of approximately 10% annually over the next five years. The minimal residual-disease-testing market stands to gain from this heightened awareness, as more practitioners incorporate these tests into standard care protocols.