Growing Investment in Cancer Research

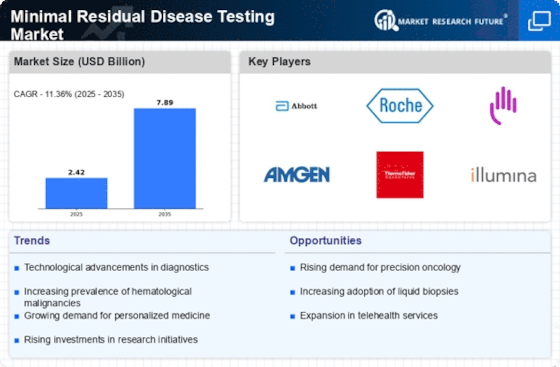

The Minimal Residual Disease Testing Market is benefiting from a surge in investment directed towards cancer research. Funding from both public and private sectors is increasingly allocated to studies focused on improving diagnostic and therapeutic approaches for cancer treatment. This influx of capital is fostering innovation in minimal residual disease testing methodologies, enhancing their reliability and applicability in clinical settings. As research progresses, new biomarkers and testing techniques are likely to emerge, further enriching the Minimal Residual Disease Testing Market. The commitment to advancing cancer research not only supports the development of novel testing solutions but also reinforces the importance of early detection and intervention.

Increased Focus on Personalized Medicine

The Minimal Residual Disease Testing Market is significantly influenced by the growing emphasis on personalized medicine. As healthcare shifts towards tailored treatment approaches, the need for precise monitoring of residual disease becomes paramount. This trend is particularly evident in hematological malignancies, where minimal residual disease testing plays a crucial role in guiding therapy decisions. The market is expected to expand as healthcare providers increasingly adopt these tests to customize treatment plans based on individual patient profiles. This focus on personalization not only enhances treatment efficacy but also aligns with the broader movement towards patient-centered care, thereby propelling the Minimal Residual Disease Testing Market.

Technological Advancements in Testing Methods

The Minimal Residual Disease Testing Market is experiencing a surge in technological advancements that enhance the accuracy and efficiency of testing methods. Innovations such as next-generation sequencing (NGS) and digital PCR are becoming increasingly prevalent, allowing for the detection of minimal residual disease at unprecedented sensitivity levels. These technologies enable clinicians to monitor treatment responses more effectively, potentially leading to improved patient outcomes. The market for NGS alone is projected to reach substantial figures, indicating a robust growth trajectory. As these technologies continue to evolve, they are likely to drive the Minimal Residual Disease Testing Market forward, facilitating earlier interventions and personalized treatment strategies.

Rising Incidence of Hematological Malignancies

The Minimal Residual Disease Testing Market is witnessing growth driven by the rising incidence of hematological malignancies, such as leukemia and lymphoma. As the prevalence of these diseases increases, the demand for effective monitoring and treatment strategies intensifies. Minimal residual disease testing has emerged as a critical tool in assessing treatment efficacy and predicting relapse, thereby becoming integral to patient management. According to recent statistics, the incidence of leukemia is projected to rise, further underscoring the necessity for advanced testing solutions. This trend is likely to bolster the Minimal Residual Disease Testing Market, as healthcare systems seek to implement more robust monitoring protocols.

Regulatory Support for Advanced Testing Solutions

The Minimal Residual Disease Testing Market is positively impacted by regulatory support aimed at facilitating the adoption of advanced testing solutions. Regulatory bodies are increasingly recognizing the importance of minimal residual disease testing in improving patient outcomes and are streamlining approval processes for innovative diagnostic tools. This supportive regulatory environment encourages manufacturers to invest in research and development, leading to the introduction of more sophisticated testing options. As regulations evolve to accommodate new technologies, the Minimal Residual Disease Testing Market is likely to experience accelerated growth, as healthcare providers gain access to cutting-edge solutions that enhance patient care.