Increasing Prevalence of Chronic Diseases

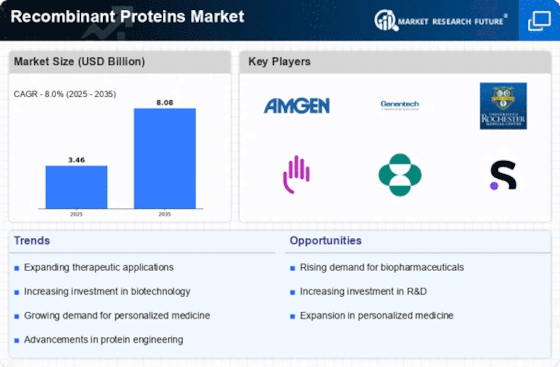

The rising incidence of chronic diseases such as diabetes, cancer, and cardiovascular disorders is a pivotal driver for the Recombinant Proteins Market. As these conditions become more prevalent, the demand for effective therapeutic solutions intensifies. Recombinant proteins, known for their efficacy and safety, are increasingly utilized in treatment regimens. According to recent estimates, the market for recombinant proteins is projected to reach approximately USD 500 billion by 2026, reflecting a compound annual growth rate of around 8%. This growth is largely attributed to the increasing reliance on biopharmaceuticals for chronic disease management, thereby propelling the Recombinant Proteins Market forward.

Regulatory Support for Biopharmaceuticals

Regulatory frameworks that support the development and approval of biopharmaceuticals are instrumental in shaping the Recombinant Proteins Market. Regulatory agencies are increasingly streamlining the approval processes for recombinant proteins, thereby facilitating faster market entry for new products. This supportive environment encourages pharmaceutical companies to invest in the development of recombinant therapeutics. Recent initiatives aimed at expediting the review of biologics have resulted in a notable increase in the number of approved recombinant products. As a consequence, the Recombinant Proteins Market is poised for growth, driven by the influx of new and innovative therapeutic options.

Rising Demand for Vaccines and Therapeutics

The escalating demand for vaccines and therapeutics, particularly in the context of infectious diseases, is a significant driver for the Recombinant Proteins Market. Recombinant proteins play a vital role in vaccine development, serving as antigens that elicit immune responses. The ongoing efforts to combat various infectious diseases have led to an increased focus on recombinant protein-based vaccines. Market analysis suggests that the recombinant vaccine segment is anticipated to grow at a rate of 12% annually, reflecting the urgent need for effective immunization strategies. This trend is likely to enhance the overall growth of the Recombinant Proteins Market.

Growing Investment in Biotechnology Research

The surge in investment directed towards biotechnology research is a crucial driver for the Recombinant Proteins Market. Governments and private entities are increasingly funding research initiatives aimed at developing novel therapeutic proteins. This influx of capital is fostering innovation and accelerating the discovery of new recombinant proteins for various applications, including therapeutics and diagnostics. Reports indicate that biotechnology research funding has seen a year-on-year increase of approximately 10%, which is likely to enhance the pipeline of recombinant protein products. Consequently, this trend is expected to bolster the Recombinant Proteins Market as new products enter the market.

Technological Innovations in Protein Production

Technological advancements in the production of recombinant proteins are significantly influencing the Recombinant Proteins Market. Innovations such as improved expression systems, enhanced purification techniques, and the use of cell-free systems are streamlining production processes. These advancements not only increase yield but also reduce production costs, making recombinant proteins more accessible. For instance, the introduction of mammalian cell culture systems has improved the post-translational modifications of proteins, enhancing their therapeutic efficacy. As a result, the market is expected to witness a surge in the adoption of these technologies, further driving growth in the Recombinant Proteins Market.