Expansion of Coffee Retail Outlets

The Raw Coffee Bean Market is significantly influenced by the expansion of coffee retail outlets, including cafes, specialty shops, and online platforms. The proliferation of these establishments has made coffee more accessible to consumers, thereby increasing overall consumption. Data suggests that the number of coffee shops has grown by over 10% in recent years, particularly in urban areas where coffee culture thrives. This expansion not only boosts demand for raw coffee beans but also encourages innovation in product offerings, such as single-origin and organic coffees. As more consumers seek premium coffee experiences, the Raw Coffee Bean Market is poised for further growth, driven by the increasing number of retail outlets catering to diverse consumer preferences.

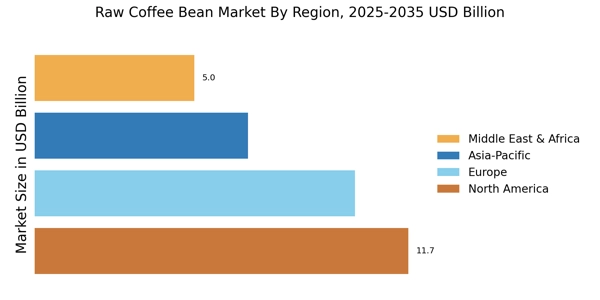

Emerging Markets and New Consumer Bases

The Raw Coffee Bean Market is witnessing growth in emerging markets, where coffee consumption is on the rise. Countries in Asia and Africa are experiencing a burgeoning middle class that is increasingly adopting coffee as a staple beverage. Market data indicates that coffee consumption in these regions is expected to grow by over 5% annually, driven by urbanization and changing lifestyles. This trend presents new opportunities for coffee producers to tap into these expanding consumer bases. As the Raw Coffee Bean Market adapts to the preferences and purchasing power of these emerging markets, it is likely to experience significant growth and diversification in product offerings.

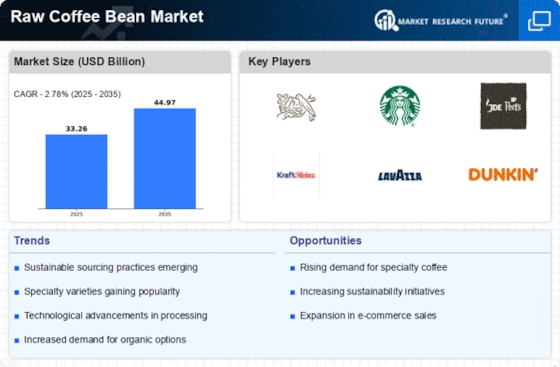

Increasing Demand for Coffee Consumption

The Raw Coffee Bean Market is experiencing a notable surge in demand, driven by the rising global consumption of coffee. Recent statistics indicate that coffee consumption has increased by approximately 2.5% annually, with a significant portion attributed to younger demographics who favor specialty and artisanal coffee. This trend suggests a shift in consumer preferences towards higher quality and diverse coffee offerings. As a result, coffee producers are compelled to enhance their supply chains and sourcing strategies to meet this growing demand. The increasing popularity of coffee shops and cafes further fuels this trend, as consumers seek unique coffee experiences. Consequently, the Raw Coffee Bean Market is likely to witness sustained growth as it adapts to these evolving consumer preferences.

Sustainability and Ethical Sourcing Trends

The Raw Coffee Bean Market is increasingly shaped by sustainability and ethical sourcing trends. Consumers are becoming more conscious of the environmental and social impacts of their purchases, leading to a growing preference for sustainably sourced coffee. Reports indicate that sales of certified organic and fair-trade coffee have risen significantly, reflecting a shift towards responsible consumption. This trend compels producers to adopt sustainable farming practices and transparent supply chains, which can enhance brand loyalty among consumers. As the demand for ethically sourced coffee continues to rise, the Raw Coffee Bean Market must adapt to these expectations, potentially leading to innovations in sourcing and production methods.

Technological Advancements in Coffee Processing

The Raw Coffee Bean Market is benefiting from technological advancements in coffee processing techniques. Innovations such as improved roasting methods and enhanced quality control measures are enabling producers to deliver superior coffee products. Recent developments in processing technology have led to more efficient extraction methods, which can enhance flavor profiles and reduce waste. This not only improves the quality of the final product but also increases the overall efficiency of production. As technology continues to evolve, the Raw Coffee Bean Market is likely to see further enhancements in processing capabilities, which could lead to increased competitiveness and profitability for producers.