Sustainability Initiatives

The Quantum Computing in Automotive Market is increasingly aligned with sustainability goals. Quantum computing can optimize energy consumption in electric vehicles and improve battery efficiency, which is essential for reducing the carbon footprint of the automotive sector. By leveraging quantum algorithms, manufacturers can enhance the design and production processes, leading to more sustainable practices. It is estimated that the integration of quantum computing could lead to a 20% increase in energy efficiency in automotive applications. This focus on sustainability not only meets regulatory requirements but also resonates with environmentally conscious consumers, thus propelling the Quantum Computing in Automotive Market forward.

Enhanced Security Protocols

In the context of the Quantum Computing in Automotive Market, the need for robust security measures is paramount. As vehicles become more connected, the risk of cyber threats escalates. Quantum computing presents innovative solutions for encryption and data protection, potentially rendering traditional security methods obsolete. The automotive sector is projected to invest over 15 billion dollars in cybersecurity measures by 2026, with quantum technologies playing a crucial role in safeguarding sensitive information. This emphasis on security not only protects consumers but also fosters trust in autonomous and connected vehicle technologies, thereby driving growth in the Quantum Computing in Automotive Market.

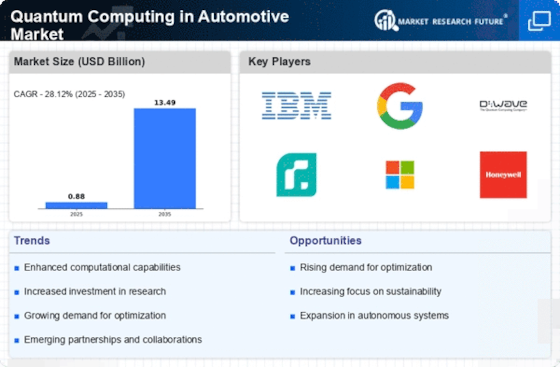

Increased Computational Power

The Quantum Computing in Automotive Market is witnessing a surge in demand for enhanced computational capabilities. Quantum computing offers the potential to process vast amounts of data at unprecedented speeds, which is crucial for applications such as real-time traffic analysis and predictive maintenance. As automotive manufacturers increasingly rely on data-driven insights, the ability to analyze complex datasets rapidly becomes a competitive advantage. Reports indicate that the automotive sector could see a 30% reduction in operational costs through the implementation of quantum algorithms for optimization tasks. This increased computational power not only streamlines operations but also enhances the overall driving experience, making it a pivotal driver in the Quantum Computing in Automotive Market.

Advancements in Machine Learning

Machine learning is a critical component of the Quantum Computing in Automotive Market, as it enables vehicles to learn from data and improve their performance over time. Quantum computing enhances machine learning algorithms, allowing for more sophisticated models that can analyze complex patterns in driving behavior and environmental conditions. This capability is particularly relevant for the development of autonomous vehicles, where real-time decision-making is essential. The automotive industry is expected to allocate approximately 10 billion dollars to machine learning initiatives by 2025, with quantum technologies playing a vital role in this evolution. The synergy between quantum computing and machine learning is likely to drive innovation and efficiency in the Quantum Computing in Automotive Market.

Regulatory Compliance and Innovation

The Quantum Computing in Automotive Market is influenced by the need for compliance with evolving regulations. As governments worldwide implement stricter emissions and safety standards, quantum computing can facilitate compliance through advanced simulations and modeling. This technology allows manufacturers to test and validate new designs more efficiently, reducing time to market. Furthermore, the automotive sector is projected to invest around 12 billion dollars in research and development to meet these regulatory demands by 2025. The ability to innovate while adhering to regulations positions quantum computing as a key driver in the Quantum Computing in Automotive Market, fostering a culture of continuous improvement and technological advancement.