Breakthroughs in Quantum Algorithms

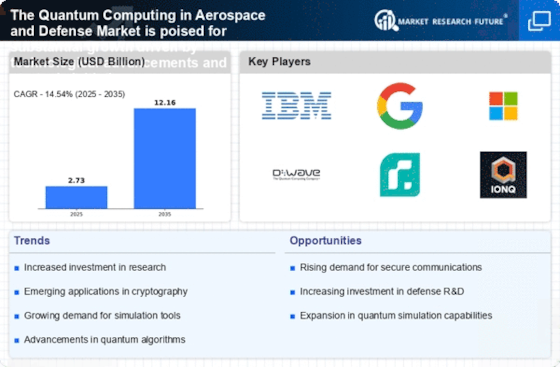

Recent advancements in quantum algorithms are catalyzing the evolution of the Aerospace & defense Market. Quantum Computing in Aerospace & Defense Market is benefiting from these breakthroughs, which enable faster and more efficient problem-solving capabilities. For example, algorithms designed for optimization and machine learning can significantly enhance predictive maintenance and logistics management. The potential to reduce computational time from years to mere seconds could transform how defense contractors approach complex simulations and analyses. As research institutions and private enterprises continue to collaborate on algorithm development, the market is likely to see a proliferation of innovative applications that leverage quantum computing.

Emerging Applications in Defense Systems

The emergence of novel applications for quantum computing within defense systems is reshaping the Aerospace & Defense Market. Quantum Computing in Aerospace & Defense Market is witnessing a surge in interest for applications such as secure communications, advanced cryptography, and enhanced surveillance systems. The ability of quantum systems to perform complex calculations at unprecedented speeds could lead to breakthroughs in threat detection and response strategies. As defense agencies seek to enhance their operational capabilities, the integration of quantum technologies into existing systems appears to be a priority, potentially leading to a paradigm shift in how defense operations are conducted.

Strategic Partnerships and Collaborations

The formation of strategic partnerships and collaborations among technology firms, defense contractors, and research institutions is a driving force in the Aerospace & Defense Market. Quantum Computing in Aerospace & Defense Market is increasingly characterized by joint ventures aimed at accelerating the development and deployment of quantum technologies. These collaborations often pool resources and expertise, facilitating the rapid advancement of quantum applications. For instance, partnerships between tech giants and defense agencies have led to the establishment of dedicated research centers focused on quantum computing. Such initiatives not only enhance innovation but also ensure that the defense sector remains at the forefront of technological advancements.

Regulatory Support and Funding Initiatives

Regulatory support and funding initiatives from government entities are playing a crucial role in the growth of the Aerospace & Defense Market. Quantum Computing in Aerospace & Defense Market is benefiting from increased governmental focus on quantum technologies, with various countries allocating substantial budgets for research and development. For example, recent funding announcements indicate that several nations are investing billions into quantum research, recognizing its strategic importance. This financial backing is likely to stimulate innovation and attract talent to the sector, thereby fostering a conducive environment for the commercialization of quantum solutions in defense applications.

Increased Demand for Advanced Computing Solutions

The Aerospace & Defense Market is witnessing a pronounced demand for advanced computing solutions, driven by the need for enhanced operational efficiency and decision-making capabilities. Quantum Computing in Aerospace & Defense Market is poised to address complex computational challenges that traditional systems struggle with. For instance, the ability to process vast datasets in real-time can lead to improved mission planning and resource allocation. As defense budgets continue to grow, with projections indicating a rise to over 2 trillion dollars by 2026, investments in quantum technologies are likely to surge. This trend suggests that organizations are increasingly recognizing the potential of quantum computing to revolutionize their operational frameworks.