Advancements in Quantum Hardware

Advancements in quantum hardware are a pivotal driver for the Quantum Computing Market. Innovations in qubit design, error correction techniques, and cooling technologies are enhancing the performance and scalability of quantum systems. Companies are actively developing superconducting qubits, trapped ions, and topological qubits, each offering unique advantages for different applications. The race to build more stable and reliable quantum computers is intensifying, with several firms reporting breakthroughs in qubit coherence times and gate fidelities. As hardware capabilities improve, the potential applications of quantum computing expand, attracting interest from various sectors. This ongoing evolution in quantum hardware is likely to catalyze further investment and research, solidifying the industry's growth.

Government Initiatives and Funding

Government initiatives play a crucial role in propelling the Quantum Computing Market forward. Various nations are investing heavily in quantum research and development, recognizing its potential to revolutionize technology and maintain competitive advantages. For instance, funding programs aimed at fostering public-private partnerships are becoming increasingly common. These initiatives not only provide financial support but also facilitate collaboration among academia, industry, and government entities. In recent years, several countries have announced multi-billion dollar investments in quantum technology, which are expected to accelerate advancements and commercialization efforts. Such government backing is likely to enhance the overall ecosystem, driving innovation and attracting talent to the quantum computing sector.

Emergence of Quantum-as-a-Service Models

The emergence of Quantum-as-a-Service (QaaS) models is transforming the Quantum Computing Market by making quantum technologies more accessible. These models allow businesses to leverage quantum computing resources without the need for substantial upfront investments in hardware. Cloud-based quantum computing platforms are being developed by leading technology firms, enabling organizations to experiment with quantum algorithms and applications on a pay-per-use basis. This democratization of quantum computing is expected to accelerate adoption across various industries, including healthcare, finance, and logistics. As more companies recognize the potential of quantum solutions, the QaaS model is likely to drive significant growth in the market, fostering innovation and collaboration.

Growing Interest in Quantum Cryptography

The Quantum Computing Market is witnessing a growing interest in quantum cryptography, which offers unprecedented security features. As cyber threats become more sophisticated, organizations are seeking robust solutions to protect sensitive data. Quantum cryptography leverages the principles of quantum mechanics to create secure communication channels that are theoretically immune to eavesdropping. This has led to increased investments in quantum key distribution technologies, which are gaining traction among financial institutions and government agencies. The market for quantum cryptography is expected to expand significantly, with projections indicating a potential market size of over 1 billion dollars by 2027. This trend underscores the importance of quantum technologies in enhancing cybersecurity measures.

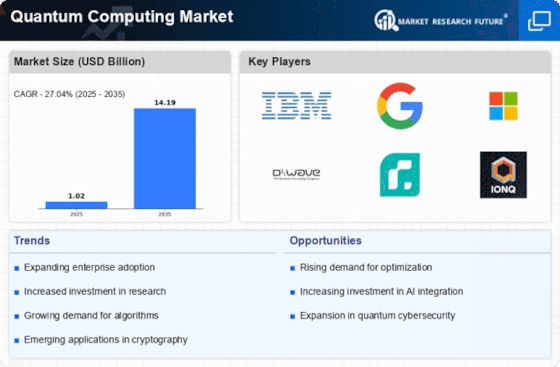

Rising Demand for Advanced Computing Solutions

The Quantum Computing Market is experiencing a notable surge in demand for advanced computing solutions. As traditional computing systems struggle to handle complex problems, industries such as finance, pharmaceuticals, and logistics are increasingly turning to quantum computing for its unparalleled processing capabilities. This shift is driven by the need for faster data analysis and optimization, which quantum computers can provide. According to recent estimates, the quantum computing market is projected to reach a valuation of approximately 65 billion dollars by 2030, indicating a robust growth trajectory. The ability of quantum systems to solve problems that are currently intractable for classical computers positions them as a vital tool for innovation across various sectors.