Emergence of Quantum Startups

The emergence of quantum startups is significantly influencing the Enterprise Quantum Computing Market. A wave of innovative companies is entering the market, focusing on developing quantum hardware, software, and applications. These startups are often backed by venture capital, which has seen investments in quantum technology exceed 1 billion USD in recent years. This influx of new players is fostering competition and driving technological advancements, as startups strive to differentiate themselves in a rapidly evolving landscape. Moreover, established tech companies are increasingly partnering with these startups to accelerate their quantum initiatives. This dynamic ecosystem is likely to enhance the overall growth of the Enterprise Quantum Computing Market, as new solutions and applications are developed.

Government Initiatives and Funding

Government initiatives and funding play a crucial role in the development of the Enterprise Quantum Computing Market. Various governments are investing heavily in quantum research and development to maintain a competitive edge in technology. For instance, funding programs aimed at fostering innovation in quantum technologies have been established, with budgets reaching billions of dollars. These initiatives not only support academic research but also encourage collaboration between public and private sectors. The establishment of national quantum strategies in several countries indicates a commitment to advancing quantum computing capabilities. As a result, the Enterprise Quantum Computing Market is likely to benefit from increased resources and support, facilitating the growth of quantum technologies and their applications.

Growing Interest in Quantum Security Solutions

As cyber threats become more sophisticated, the need for robust security solutions is paramount, leading to a growing interest in quantum security within the Enterprise Quantum Computing Market. Quantum cryptography, which leverages the principles of quantum mechanics to secure data transmission, is gaining traction among enterprises seeking to protect sensitive information. The potential for quantum computing to break traditional encryption methods has prompted organizations to explore quantum-resistant algorithms and security protocols. This shift is expected to drive investments in quantum security technologies, with the market projected to grow significantly in the coming years. As enterprises prioritize cybersecurity, the Enterprise Quantum Computing Market is likely to see increased demand for quantum security solutions.

Rising Demand for Advanced Computing Solutions

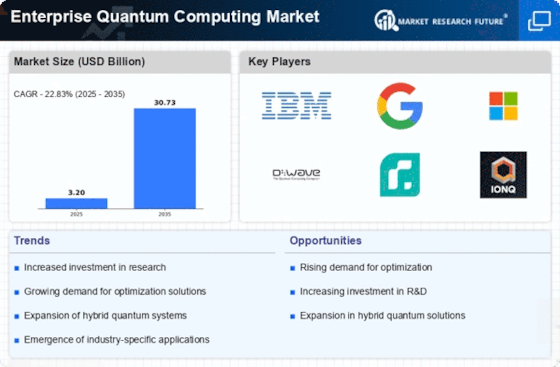

The Enterprise Quantum Computing Market is experiencing a surge in demand for advanced computing solutions. Organizations across various sectors are increasingly recognizing the limitations of classical computing in solving complex problems. Quantum computing offers the potential to process vast amounts of data at unprecedented speeds, which is particularly appealing for industries such as finance, pharmaceuticals, and logistics. According to recent estimates, the market for quantum computing is projected to reach approximately 10 billion USD by 2026, driven by the need for enhanced computational capabilities. This demand is further fueled by the growing interest in machine learning and artificial intelligence, where quantum computing could provide significant advantages. As enterprises seek to leverage these technologies, the Enterprise Quantum Computing Market is poised for substantial growth.

Advancements in Quantum Algorithms and Software

Advancements in quantum algorithms and software are pivotal to the evolution of the Enterprise Quantum Computing Market. Researchers and developers are continuously working on creating more efficient algorithms that can harness the power of quantum computing for practical applications. Breakthroughs in quantum algorithms, such as those for optimization and simulation, are opening new avenues for industries like finance, healthcare, and materials science. The development of user-friendly quantum programming languages and software platforms is also facilitating broader access to quantum computing capabilities. As these advancements continue, they are expected to enhance the applicability of quantum technologies, thereby driving growth in the Enterprise Quantum Computing Market.