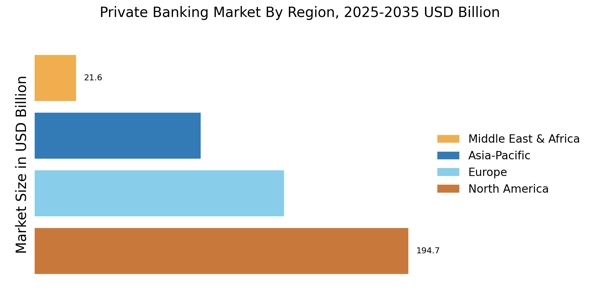

North America : Financial Powerhouse of the World

North America remains the largest market for private banking, holding approximately 45% of the global share. Key growth drivers include a robust economy, high net worth individual (HNWI) population, and increasing demand for personalized financial services. Regulatory frameworks, such as the Dodd-Frank Act, have also shaped the landscape, ensuring transparency and consumer protection. The United States is the leading country in this region, with major players like JPMorgan Chase, Goldman Sachs, and Morgan Stanley dominating the market. The competitive landscape is characterized by a mix of traditional banks and fintech firms, all vying for the affluent clientele. The presence of established institutions and innovative startups fosters a dynamic environment, enhancing service offerings and client engagement.

Europe : Diverse and Evolving Market

Europe is the second-largest market for private banking, accounting for around 30% of the global share. The region's growth is driven by increasing wealth among HNWIs, evolving client expectations, and stringent regulatory measures like the MiFID II directive, which enhances investor protection and transparency. Countries like Switzerland and the UK are pivotal, with their favorable tax regimes and strong financial services infrastructure. Switzerland, home to UBS and Credit Suisse, leads the market, while the UK follows closely with significant contributions from Barclays and Deutsche Bank. The competitive landscape is marked by a blend of traditional banks and emerging digital platforms, catering to diverse client needs. The focus on sustainable investing and wealth management solutions is reshaping service offerings, making the market more dynamic and client-centric.

Asia-Pacific : Emerging Market Potential

Asia-Pacific is witnessing rapid growth in the private banking sector, holding approximately 20% of the global market share. The region's economic expansion, rising disposable incomes, and increasing number of HNWIs are key drivers. Countries like China and India are at the forefront, with favorable regulatory environments encouraging foreign investments and wealth management services. China, with its burgeoning affluent class, is a significant player, while Australia and Singapore also contribute to the market's growth. The competitive landscape features both local banks and international players, such as Citi Private Bank, striving to capture the growing demand for personalized financial services. The focus on technology and digital solutions is reshaping client interactions, making the market more accessible and efficient.

Middle East and Africa : Untapped Wealth Opportunities

The Middle East and Africa region is emerging as a significant player in the private banking market, holding about 5% of the global share. The growth is driven by increasing wealth from oil revenues, a rising number of HNWIs, and a growing interest in investment opportunities. Countries like the UAE and South Africa are leading the charge, with regulatory frameworks evolving to support wealth management services. The UAE, particularly Dubai, is becoming a hub for private banking, attracting global players and fostering a competitive landscape. Key institutions like BNP Paribas and local banks are expanding their offerings to cater to affluent clients. The focus on diversification of investments and wealth preservation strategies is shaping the market, making it an attractive destination for private banking services.